Key Takeaways

Stable value funds play a critical role in DC plans, historically providing principal preservation, consistent positive returns, liquidity for benefit payments, and financial confidence for participants.

Higher interest rates have challenged stable value funds; however, over the long term, they have historically outperformed money market funds.

Now may be a good time to investigate the stable value market to determine how your plan might potentially benefit from the current rate environment.

Stable value funds and money market funds are often compared in terms of their returns … but only one has had consistent performance over the long term.

Stable value funds have become quite popular in the tax-qualified investment landscape since their introduction 50 years ago, with about $841 billion currently invested in the space.1 They play a critical role in defined contribution (DC) plans, providing principal preservation, consistent positive returns, and liquidity for participant distributions. These funds use investment contracts that guarantee a minimum interest rate and allow participants to withdraw their savings at contract value, regardless of the market value of the assets that support the contract.

Steady returns, lower investment risk

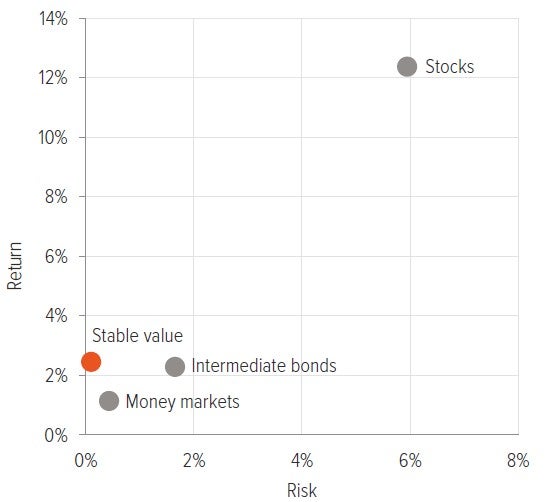

Stable value funds have historically offered consistent returns with exceptionally low volatility, making them an attractive choice for risk-averse participants. These funds invest in short- and intermediate-term securities, which offer higher potential returns than money market–eligible securities. Over the last 15 years, stable value funds have delivered higher annualized returns with lower investment risk compared with money market funds (Exhibit 1).

As of 06/30/25. Source: Stable Value Investment Association. Performance measured by gross annualized returns. Risk measured by standard deviation. See back page for index definitions and other disclosures.

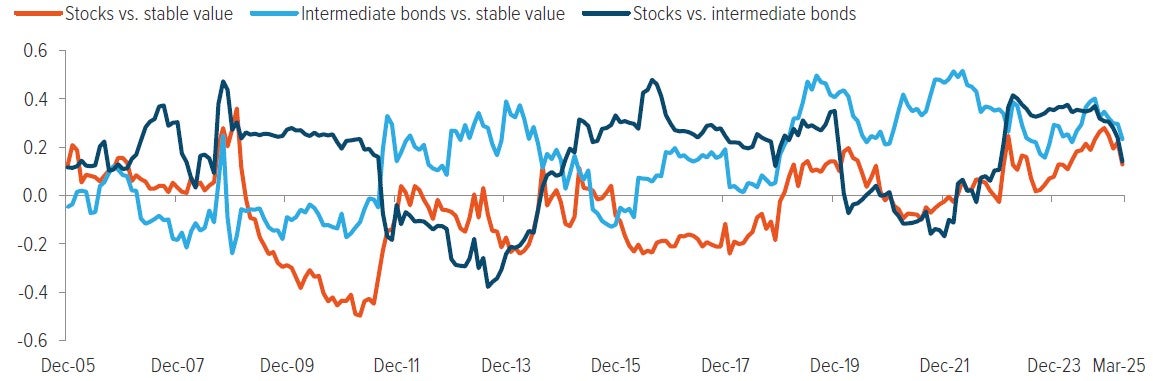

Another benefit of stable value is its low (and often negative) correlation to other asset classes, which makes it an effective diversifier in a portfolio (Exhibit 2).

As of 03/31/25. Source: Voya IM, Stable Value Investment Association. Past performance does not guarantee future results. Investors may not invest directly in an index.

The behavioral finance component behind stable value fund design is also critical. Retirees and participants approaching retirement who invest in stable value may gain comfort knowing their principal is guaranteed by an insurance wrapper, unlike with money market funds—which came into focus during the global financial crisis when the funds’ net asset value “broke the buck” and dipped below $1.00, alarming investors who had assumed that money market funds were the same as cash.

Money markets, stable value and interest rates

Money market and stable value funds are often compared in terms of their returns. Money market funds have had the edge recently, as stable value market-tobook ratios fell below 100% in 2022 after the Federal Reserve began hiking interest rates. Because money market funds can reinvest cash flows from maturing securities into higher-yielding securities, they tend to outperform stable value funds during such periods. Still, stable value has performed exactly as intended despite the fastest pace of rate hikes in history.

Additionally, short-term rates have exceeded long-term rates since December 2022 (creating an inverted yield curve), giving a yield advantage to money market funds, which have no exposure to longer-duration securities as stable value funds do. However, history shows that stable value funds generally recapture the return advantage over money market funds as conditions normalize.2

While both stable value and money market funds seek principal preservation, stable value has historically offered additional long-term benefits, including consistent intermediate bond–like returns without the volatility of fixed income. as well as low correlations with other asset classes.

Evaluating stable value funds and managers

Selecting investment managers and wrap providers requires careful evaluation, as stable value funds are not one-size-fits-all. Consider:

- Plan design

- How many inactive or retired participants are in the plan

- The experience of the investment manager

- The performance of both the underlying investments and the stable value fund versus applicable benchmarks

- The credit quality of the underlying investments and the contract issuers

- The termination provisions in the stable value contracts

Stable value funds have proven to be a reliable option for risk-averse participants, offering a compelling combination of benefits and an attractive risk/reward profile. While money market funds may outperform in the short term in rising rate environments, stable value funds have consistently delivered strong performance over the long term.