About the Survey

From mid-February to early March 2023, Voya Investment Management (Voya IM) repeated its online survey of retirement plan sponsors and DC specialists focused on the retirement plan market to:

- Identify the evolving priorities and service needs of plan sponsors

- Help DC specialists align their service offerings to the priorities of plan sponsor clients and prospects

- Identify unfolding opportunities and offer suggestions for DC specialists to help address them

Previous waves of the survey were conducted in March 2021, December 2018 and April 2016.

The survey was expanded in 2023 to include contributing participants for the first time, in an effort to better understand their perspectives on issues such as retirement readiness investing, and financial confidence.

Certain exhibits distinguish plan sponsor segments by size of plan. The study divided sponsors into three segments: plans with $1 million to less than $5 million, plans with $5 million to less than $25 million, and plans with more than $25 million. In other exhibits, the study distinguishes between heavy-focus DC specialists, whose practices emphasize plan sponsor clients, and emerging DC specialists, for whom plan sponsors represent a smaller proportion of business. Details on the definitions and methodologies of the study can be found in the Appendix. Some exhibits may not sum due to rounding.

Key Findings

- When it comes to retirement readiness, participants said they are much less prepared than both plan sponsors and DC specialists believe.

- Ensuring the plan’s regulatory compliance and that participants are appropriately invested are the two most important areas of short-term focus for both sponsors and specialists.

- Cybersecurity and reasonable plan fees were the top concerns of both sponsors and specialists.

- Sponsors said they value guidance from specialists on retirement income investment options and investment selection/monitoring more than any other services.

- As in previous editions of the survey, specialists again said they provide an array of services that plan sponsors do not acknowledge, pointing to a persistent communications problem.

- Specialists and sponsors agreed that annualized performance and historical rolling returns are the most important investment selection factors to consider, while deprioritizing other factors such as R-squared and Sortino ratio.

- Sponsors recognize that an aging participant base has brought focus on the growing need for retirement income products but cite cost and complexity as key challenges in offering these products.

- Since 2021, sponsors have increased their adoption of financial wellness programs and tools; top barriers to adding these programs include cost and difficulty in measuring outcomes.

- Sponsors and specialists underestimate the number of employees who act as caregivers, suggesting an opportunity to educate and support sponsors in these efforts.

Introduction

Welcome to the fourth edition of Voya Investment Management’s (Voya IM’s) survey of retirement plan sponsors and DC specialists. The survey seeks to help specialists better understand the needs of their clients and prospects — what products and services do sponsors want, what needs are unmet, and where are business opportunities emerging?

Economic backdrop

Our survey was conducted from mid-February to early March 2023, not long after the passage of the SECURE 2.0 Act in late December 2022. This legislation aims to

help participants preserve income through changes to the rules for required minimum distributions, Roth distributions, and mandatory coverage of long-term part-time workers.

The economic recovery from the Covid pandemic that began during the second half of 2021 was challenged on multiple fronts heading into 2022 — namely, by the crisis in Ukraine, rising inflation and sustained market volatility.

As respondents were completing the survey, 2023 had begun shaping up into another difficult year. Further volatility across multiple asset classes is expected due to now-familiar headwinds: inflation that overshoots the Federal Reserve’s 2% target, interest rate hikes that could continue for longer than initially expected, and the possibility of recession through year-end (and perhaps even into 2024). The collapse of Silicon Valley Bank and other banking crises in the first half of 2023 have added to the turmoil.

Participant retirement readiness

This year, we surveyed participants for the first time, and their responses show just how much both plan sponsors and DC specialists overestimate participant retirement readiness.

Only 63% of participants said they feel somewhat or very prepared for retirement. Meanwhile, 87% of sponsors said that participants fall into those two categories, and 71% of DC specialists believed that participants are somewhat or very prepared for retirement (Exhibit 1).

Exhibit 1. Participants are less optimistic about their retirement readiness than plan sponsors and DC specialists perceive

Historically, sponsors and specialists have had divergent views on participant retirement readiness; sponsors have generally felt that participants are better prepared for retirement than specialists have (Exhibit 2).

Exhibit 2. Sponsors have been consistently more optimistic about participant retirement readiness than specialists, even in bear markets

The impact of market volatility, inflation and Covid on participants

More than half of participants surveyed reported that inflation and the state of the economy will have a severe or major impact on their ability to save for retirement, while Covid was much less frequently cited as an obstacle to retirement savings. 37% of participants over age 50 said that they are now planning to retire later than originally hoped due to the long-term effects of market volatility, inflation and Covid.

Plan sponsors and DC specialists had differing views on the top long-term combined effects of Covid, recent market volatility, and rising inflation on retirement plans and employee benefits. Sponsors cited an increase in participant investment changes and hardship withdrawal activity as well as higher demand for emergency savings benefits, while specialists pointed to an increase in hardship withdrawals, plan loan activity, and demand for financial wellness and education programs (Exhibit 3).

Exhibit 3. Covid, market volatility and inflation have led to increased participant investment changes and hardship withdrawal activity and higher demand for emergency savings benefits

Plan Sponsor Priorities and Challenges

Our survey results demonstrate that DC specialists have a solid grasp on plan sponsors’ priorities. The two groups agreed that ensuring regulatory compliance and ensuring that participants are appropriately invested are important areas of focus in the near term, as are helping participants transition to retirement and increasing plan participation and contribution levels.

Sponsor priorities for the next two years

As in 2018 and 2021, sponsors’ top concern remained was to ensure that their plans comply with new regulations. Reducing plan fees and expenses has been a recurrent focus that has grown in significance since 2021, moving from fifth place in the previous survey to third place this year. Specialists with a heavy focus on retirement plans agreed with sponsors’ areas of focus but assigned greater importance to increasing plan participation and contribution levels (Exhibit 4).

Exhibit 4. Regulatory compliance and appropriate participant asset allocation are top areas of focus in next two years

For ideas on how to uncover plan sponsor goals, see Sponsor Priorities and Challenges in the Calls to Action section at the end of this report.

Sponsors of larger plans were more concerned than those of smaller plans about increasing participant rates and contribution levels, adding a retirement income solution/product, and helping participants with holistic financial wellness.

More sponsors were concerned this year with reducing plan fees and expenses, ensuring that participants are appropriately invested, and helping participants transition to retirement. Conversely, fewer sponsors were focused on increasing plan participation, adding or changing plan features, and helping participants with financial wellness than in 2021.

Sponsor concerns with retirement plan issues

DC specialists show a strong understanding of plan sponsors’ concerns. The two groups closely aligned on threats to cybersecurity, reasonable plan fees, managing the complexity of plan oversight, and reducing plan leakage due to loans and hardship withdrawals. Sponsors were less concerned with responding to regulatory changes, participant education, and threat of plan litigation than specialists perceived (Exhibit 5).\

Exhibit 5. Sponsors are most concerned about managing the complexity of overseeing their plan and ensuring plan fees remain reasonable

The most frequently mentioned unprompted significant challenges for sponsors were educating employees about retirement savings and plan details and increasing participation/contribution levels. Responses were generally similar across sponsor size segments. Specialists frequently mentioned the same issues, along with plan details and fiduciary/regulatory/compliance concerns, but to a much lesser degree than sponsors.

Plan Support

Plan sponsors and DC specialists continued to share similar views on many aspects of retirement plan support and service delivery. 85% of sponsors said they feel an increasing need for support from their specialists, up from 81% in 2021, 67% in 2018 and 68% in 2016. Heavy-focus specialists (61% of whom also responded this way) appeared to be more aware of this need than emerging specialists (26%).

98% of sponsors said they prefer working with a specialist whose focus is on retirement plans, a historically consistent sentiment. (98% in 2021, 94% in 2018, and 91% in 2016 stated the same preference.)

Desired attributes of DC specialists

When choosing a specialist, sponsors said they value guidance on retirement income investment options more than any other service cited, and more than specialists perceived value of that service (Exhibit 6).

Exhibit 6. Sponsors want a DC specialist who can advise on retirement income investment options, assist with investment selection, and work with participants on financial wellness

One major disconnect between sponsor and specialist perspectives was guidance on choosing retirement income investment options: 53% of sponsors named this factor as the top specialist attribute while only 34% of specialists saw it as a valued service they provide to sponsors. Sponsors and specialists generally placed similar importance on investment selection/monitoring and working with participants on financial planning/wellness.

Current service offerings

As in past survey results, sponsors were unlikely to fully recognize the services provided by specialists. Exhibit 7, which is sorted by percentage of sponsor recognition, illustrates these discrepancies.

Exhibit 7. Specialists provide more services than sponsors recognize

For ideas on how to better communicate your available services to sponsors, see Plan Support: Articulate Your Value in our Calls to Action at the end of this report.

Specialists were more likely than sponsors to mention that they provide all types of support to plans, and sponsors of larger plans were more likely to recognize the range of support that specialists provide than sponsors of smaller plans.

Regulatory and compliance issues

Sponsors said their top area of focus in the next two years is ensuring their plans’ regulatory compliance, which has much to do with the recent passage of the SECURE 2.0 Act of 2022. However, only 52% of sponsors said they feel overwhelmed by the increasing compliance and regulatory burdens related to their plans. Additionally, 81% of sponsors stated they want more help in understanding their fiduciary responsibilities.

Specialists have a good grasp on sponsors’ regulatory concerns, as both groups cited plan fees and fiduciary compliance as their top two areas of focus (Exhibit 8). Specialists ranked passing compliance testing as their perception of sponsors’ third top concern, while sponsors ranked timely contributions in that position.

Exhibit 8. Sponsors are most concerned about ensuring plan fees are reasonable and complying with fiduciary standards

Plan costs and fees

This year, 66% of plan sponsors indicated they are concerned about ensuring plan fees are reasonable. Most sponsors agreed that their specialists were effective in keeping overall plan costs reasonable; however, this sentiment has weakened slightly since our last survey (86% agreement in 2023 versus 93% in 2021).

Agreement with the cost and fee statements was overall aligned between sponsors and specialists (Exhibit 9). Also encouraging is that sponsors are more likely to understand the specialist’s compensation.

Exhibit 9. Sponsors understand how specialists are compensated and believe the value of the services they receive in exchange is fair

Investment Selection

In previous editions of the survey, plan sponsors ranked investment selection/monitoring as their most desired service from DC specialists. This year, that service fell to second place, with guidance on retirement income investing options (a new choice in the survey) ranking as the most desired service.

Sponsor involvement with investment selection

As in previous years, sponsors and specialists have divergent viewpoints on sponsor involvement in the investment selection process (Exhibit 10). Sponsors were more likely to rate their involvement as high, while specialists were more likely to rate sponsor involvement as moderate.

Exhibit 10. Sponsors think they are more involved in plan investment selection than specialists perceive

DC specialists as investment fiduciaries

Consistent with 2021’s survey findings, plan sponsors and DC specialists most often indicated that sponsors maintain fiduciary responsibility with respect to investment selection (Exhibit 11).

Around one-third of plan sponsors say their DC specialists have 3(38) fiduciary responsibilities, followed by those who say they belong to third-party fiduciaries (11%). DC specialists agree, with 29% stating they typically serve as an investment fiduciary. Heavy-focus specialists (37%) were more likely to indicate that they act as fiduciary versus emerging specialists (26%). About one in eight sponsors were not sure who has fiduciary responsibility.

Exhibit 11. Specialists should consider reviewing 3(38) investment fiduciary services with sponsors to ensure understanding

Understanding fiduciary services

3(21) versus 3(38) investment fiduciary services

ERISA “named” fiduciaries — typically the employer (plan sponsor) or an officer of the employer — are identified in the plan document or are deemed fiduciaries because of the functions they perform for the plan. The named fiduciary has authority over the plan’s operations and can delegate certain functions to service providers.

Under ERISA regulations, DC plan specialists can fall into one of two fiduciary roles: Section 3(21) investment advice fiduciaries or Section 3(38) investment management fiduciaries. A DC plan specialist who provides investment advice for a fee is deemed a plan fiduciary under ERISA Section 3(21). Typically, the investment advice fiduciary provides recommendations for investment options or plan features, and the named fiduciary chooses which ones to implement in the plan.

While a 3(21) fiduciary may have some measure of authority over administration of the plan, or over management and disposition of plan assets, such authority generally does not significantly shift the fiduciary burden away from the plan sponsor.

By contrast, an ERISA Section 3(38) fiduciary has the power to manage, acquire or dispose of any asset of the plan; this authority shifts the fiduciary burden of investment management from the plan sponsor onto the service provider. A Section 3(38) fiduciary must be a registered investment advisor, bank or insurance company and must acknowledge in writing that he, she, or it is a fiduciary with respect to the plan.

Structuring the investment menu

Sponsors and specialists were fairly aligned in their opinions on how to structure the plan’s investment menu. 82% of sponsors and 83% of specialists felt a plan with too many options or choices can inhibit effective investment decisions.

Additionally, 93% of sponsors and 90% of specialists agreed that offering a tiered investment menu (i.e., target date funds, core funds, and a self-directed brokerage/mutual fund window) for different types of participants can result in a better investing experience. Furthermore, 92% of sponsors and 84% of specialists said plans should consider adding a retirement tier that could include low-volatility equity, income-generating, and inflation-protecting options.

Fund selection criteria

Sponsors and specialists aligned in their view of annualized performance as the most important factor when selecting an investment (Exhibit 12). Sponsors also cited historical rolling returns and overall upside/downside capture ratio as important factors. However, specialists placed far more importance on historical rolling returns, overall upside/downside capture ratio, downside capture and third-party recommendations than sponsors.

Heavy-focus specialists were more likely to view factors such as overall capture, downside capture, information ratio, R-squared and Sortino ratio as being important to investment selection, compared with emerging specialists.

Exhibit 12. Specialists should consider educating sponsors on more technical fund performance metrics

Most sponsors cited annualized performance as the investment selection factor their specialist most frequently discussed with them. Other factors, such as historical rolling returns and up/down capture ratios, were also mentioned as discussion topics with specialists, but with significantly less frequency.

Reasons to change plan investment options

Specialists and sponsors had divergent views on the drivers of decisions to change plan investments (Exhibit 13).

For specialists, investment performance was the leading factor that drives plan investment option changes, followed by availability of lower-cost options. Material changes to the investment manager or the investment philosophy and availability of new options were cited as important secondary change drivers.

For sponsors, availability of new investments, specialist recommendations, lower-cost options, and investment performance were equally important catalysts for changing investments in the plan’s menu.

Exhibit 13. Sponsor and specialist views diverge on the key reasons to change plan investment options

Heavy-focus specialists more often cited material changes to the investment manager, change in external rating, and poor performance of existing investments as drivers to change investment options, while emerging specialists mentioned availability of new options and participant demand as such.

Use of target date funds (TDFs)

Many industry professionals now see TDFs as foundational components of a retirement plan. Nearly three-quarters of specialists said they include TDFs in all or most plans they advise. However, heavy-focus specialists (60%) are far more likely to include TDFs in all plans, compared with 32% of emerging specialists (Exhibit 14).

Exhibit 14. Most specialists include target date funds in the plans they advise

In aggregate, two-thirds of sponsors said they include TDFs in their plans now, a slightly higher measure than in 2021. Use of TDFs in mid-sized and large plans remained consistent since 2021, registering at 71% and 70%, respectively. Smaller plans have increased their usage of TDFs, from 53% in 2021 to 64% in 2023.

Does this level represent market saturation? Not quite. Of the one-third of sponsors whose plans do not currently offer TDFs, 37% said they would prefer to include them.

ESG investing

Only 53% of sponsors and 43% of specialists said participants are asking to have ESG options in the plan investment menu. Additionally, fewer specialists and sponsors have positive views of ESG investments now versus two years ago (Exhibit 15).

However, 68% of participants expressed interested in plan investment options focused on positive impact/ESG issues. And 40% of participants said they are more likely to stay with their current employer if they offer access to retirement plan investment options focused on having a positive impact ESG issues.

Exhibit 15. Sponsor and specialist sentiments around ESG investing have weakened

Retirement Income

Plan sponsors cited guidance on retirement income investment options as the top service or benefit that they look to a DC specialist to provide. However, specialists significantly underestimated the importance of this benefit; only 34% said they view it in the top three services valued by sponsors. Additionally, 73% of sponsors identified adding a retirement income solution/product as an important area of focus in the next two years.

Sponsor sentiment on the growing importance of retirement income options

80% of sponsors agreed that the SECURE Act of 2019 and the SECURE 2.0 Act of 2022 have encouraged a strong focus on retirement income. Additionally, 85% of sponsors said that an aging participant base has brought focus to the need for retirement income products, and this sentiment was even stronger among sponsors of larger plans (Exhibit 16).

Exhibit 16. Aging participants have highlighted the need for retirement income options: Sponsor views (by plan size)

To learn how to help your clients select retirement income solutions, read Voya’s How can plan sponsors help participants feel retirement-ready? article found in the Defined Contribution Insights section on voyainvestments.com.

Participant sentiment

Our research shows that participants have a relatively low level of confidence related to specific retirement income–related decisions. The number of participants who said they are not at all confident exceeded the number who said they are very confident (Exhibit 17).

Exhibit 17. Participants lack confidence in making retirement income planning decisions

Keeping terminated/retired participant assets in plan versus rollover

Sponsors are more likely to want terminated/retired participant assets to stay in the plan than DC specialists perceive. 65% of sponsors said they want to keep terminated/retired employee assets in the plan, whereas less than half of specialists thought sponsors felt that way (Exhibit 18).

Exhibit 18. Sponsors are more interested in retaining terminated/retiree assets than DC specialists perceive

But what did participants say they plan to do? Just over 25% said they will follow their financial advisor’s recommendations on what to do with their retirement assets once they retire. Another 20% said they intend to leave their assets in their current plan, while more than 10% plan on rolling their assets out of the plan (Exhibit 19). Participants over age 50 are significantly more likely to leave their assets in the plan when they retire versus participants between the ages of 18 and 49 (26% versus 16%, respectively).

Exhibit 19. Many participants don’t have a plan for their DC assets when they retire

Participant interest in retirement income options and services

As shown in Exhibit 20, most participants said they are very/somewhat interested in an investment option that helps:

- provide income during retirement

- increase understanding of how to generate income in retirement

- provide investment guidance for their retirement plan

- support transitioning to retirement

Exhibit 20. Participants want products and services that can help with retirement income planning

Current/future use of retirement income options

Offering a retirement income solution can complement an employer’s financial wellness programs (such as online tools and calculators, education on retirement income planning, and education on investing).

While many sponsors said they have plans to offer retirement income options, they are not yet widely available (Exhibit 21). About 71% of sponsors said they currently offer managed accounts, and about half offer a managed payout option; other options are less widely offered, although many sponsors intend to offer them within several years.

Exhibit 21. Most sponsors don’t currently offer a wide selection of retirement income products or investments

Key challenges in offering retirement income options

Sponsors (regardless of plan size) most frequently cited cost as the biggest obstacle to providing retirement income investment options, followed by complexity and lack of participant demand (Exhibit 22).

Exhibit 22. Sponsors are concerned about cost and complexity associated with offering retirement income solutions

Participant Support

Considering the impacts of market volatility and rising inflation (and, to a lesser extent, Covid) on plan participants, we saw participant retirement readiness as an important issue for this survey. (Sponsor, specialist, and participant perceptions of readiness are discussed in the beginning of this report.) Additionally, 30% of participants said they now plan to retire later than initially expected; for those over age 50, that percentage rises to 37%.

Barriers to participant retirement readiness

As in 2021, sponsors and specialists continued to have generally similar views on the most challenging barriers to participant retirement readiness. According to sponsors, the top barrier is participants not knowing how much money they will need upon retirement. Conversely, specialists cited insufficient participant contributions to the plan as the biggest barrier to retirement preparedness (Exhibit 23).

Sponsors were significantly more likely than specialists to say that lack of understanding and support for retirement income generation was a major barrier to retirement readiness. This discrepancy suggests that specialists should consider expanding their knowledge of retirement income solutions, so that they may provide needed support to participants.

Other challenges that sponsors ranked nearly equally include getting participants to make appropriate investment choices, participant inertia/lack of engagement and participants taking premature withdrawals or taking loans against plan assets.

Exhibit 23. Sponsors cite lack of understanding and support for retirement income solutions as a barrier to participant retirement readiness

Participant confidence in retirement plan investing

When asked to describe their investment experience, nearly 40% of participants said they are beginners or do not consider themselves investors. At the opposite end of the spectrum, only 30% of participants feel very experienced or experienced when it comes to investing (Exhibit 24). Men are significantly more likely to say they are very experienced or experienced (39%, versus 19% of women).

Exhibit 24. Many participants could use additional support in making investment decisions

Participants are looking for assistance when it comes to making investment decisions. 87% of participants are very or somewhat interested in receiving investment guidance for their retirement plan. 80% are interested in access to a financial professional whom they can call with questions and for help making investment and savings decisions.

Effectiveness of specialists’ participant education and support efforts

Sponsors and specialists agreed that specialists are generally effective in all aspects of the participant support they provide (Exhibit 25). Specialists felt less effective in preventing premature cash distributions and helping participants convert savings to retirement income.

Exhibit 25. Sponsors and specialists generally agree on specialist effectiveness in educating participants

Special needs/caregiving

As of 2020, AARP data shows that 21% of American workers are caregivers, having provided care to an adult or child with special needs.

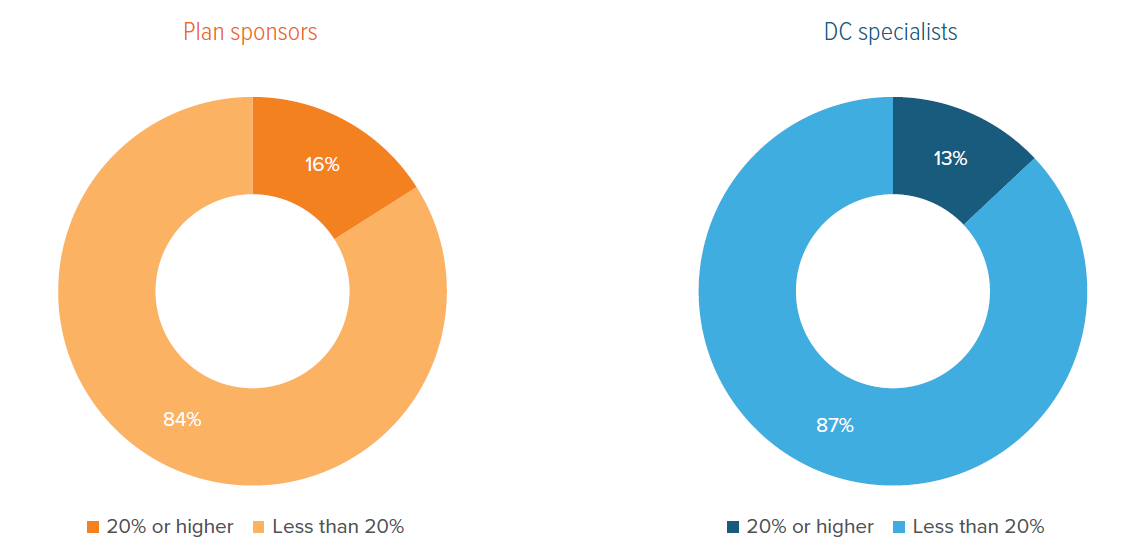

However, more than 80% of sponsors and specialists believe caregivers represent less than 20% of their participant population (Exhibit 26), showcasing a need for additional education.

Sponsors of larger plans are more likely to recognize that caregivers comprise a higher percentage of participants and are somewhat more likely than sponsors in other segments to consider it important to focus on the unique financial needs of these participants.

The good news is that even if sponsors don’t quite get the numbers right, they’re taking the issues seriously. To learn how address these concerns in your business plans, see Calls to Action.

Exhibit 26. Sponsors and specialists need additional education on the unique financial needs of caregivers

Despite the disconnect, both sponsors and specialists still find it important to focus on the financial needs of caregivers over the next two years (Exhibit 27).

Exhibit 27. Most sponsors and specialists see the importance of focusing on the financial needs of caregivers in the next two years

Financial Wellness

42% of plan sponsors identified working with participants on financial planning or other types of financial wellness or education programs as a top-three attribute for choosing their plan’s DC specialist. Additionally, 65% of sponsors identified helping participants with holistic financial wellness as an important area of focus in the next two years, which presents an excellent opportunity for specialists to assist.

Financial wellness plan goals

Plan sponsor and specialist views were mostly aligned on participant financial wellness plan goals (Exhibit 28). Specialists are increasingly focused on helping participants prioritize financial wellness.

Exhibit 28. Sponsors and specialists generally agree on participant financial wellness goals

Participant interest in financial wellness programs

More than 80% of participants said they are very/somewhat interested in education on retirement income planning, online tools and calculators, education on the cost of health care in retirement, and education on investing (Exhibit 29). About 70% said they are interested in receiving education on budgeting, health savings accounts (HSAs) and debt management. 54% expressed interest in education about 529 plans and planning for college expenses.

Exhibit 29. Education on retirement income planning is what participants want most from a financial wellness program

Usage and future adoption of financial wellness programs

The financial wellness programs that sponsors most typically offer at present are online tools and calculators, education on retirement income planning, and education on investing. Among sponsors who do not currently include each financial wellness program option, most said they are likely to start offering online tools and calculators and education on retirement income planning and investing in the next year (Exhibit 30).

Exhibit 30. Most sponsors who don’t currently offer retirement income planning tools in their financial wellness programs plan to do so in the next year

Challenges in offering financial wellness programs

Sponsors and specialists alike rated cost, complexity for the average participant, and measuring outcomes as the most significant challenges to offering financial wellness resources (Exhibit 31).

Exhibit 31. Sponsors are concerned about cost and complexity associated with offering a financial wellness program

Calls to Action

Let Voya Help You Voya is dedicated to meeting the unique requirements of DC specialists. Our primary goal is to support your needs and those of your clients. We are committed to developing long-term partnerships and enhancing the effectiveness of your business. To learn more, contact your local Voya Investment Management representative or call (800) 334-3444.

The action items below tie to the 2023 survey insights and offer suggestions on how you can incorporate them into your practice. Our goal in providing this information is to support you in serving your plan sponsor and participant clients.

Sponsors’ priorities and challenges: Keep recent legislation in mind

Following the passage of SECURE and SECURE 2.0, it’s not surprising that the most important focus areas and challenges for sponsors include helping participants transition to retirement, complying with the new regulations, keeping plan costs low, and participant investment education and financial wellness support. Use the How Do You Stack Up to Other Plan Sponsors: Benchmark Your Priorities worksheet, available in the DC section of voyainvestments.com, with your plan sponsor clients to identify their plan goals.

Plan support: Articulate your value

Before your next client meeting, create an inventory of the services you provide to each sponsor and assess how closely your services focus on those top three sponsor priorities. When you meet with your clients, use your inventory as a checklist to gauge the effectiveness of the services you provide and to remind the sponsor that you provide them. You can use the meeting as an opportunity to discuss the value you add for the fees they pay and to learn whether the client’s needs have changed. For tips on setting up a service inventory, see How Can Plan Sponsors Help Participants Feel Retirement-Ready, which is available in the DC section of voyainvestments.com.

Retirement income: Shift focus onto outcomes

Shifting perspectives and favorable legislative actions are motivating sponsors to consider adding retirement income solutions to their DC plans. Both the SECURE and SECURE 2.0 Acts have put a spotlight on the importance of retirement income solutions. To help educate sponsors, see Voya’s paper How can plan sponsors help participants feel retirement ready? available in the DC section of voyainvestments.com.

Participant support: Consider solutions for caregivers

If 20% of Americans are affected by a special need or disability, that Exhibit likely includes participants. Helping employees better protect their families builds engagement and supports recruiting and retention — factors that should prompt sponsors to embrace special needs planning. Read the financial professional practice management guide Making Special Needs Your Business, published by Voya Cares and available in the Practice Management section of voyainvestments.com (or visit voyacares.com for additional resources).

Appendix: Objectives and Method

Plan sponsor and DC specialist surveys

Brookmark Research assisted Voya IM with the development, execution and analysis of the plan sponsor and DC specialist surveys. The surveys were conducted online, as in prior years. Plan sponsor and DC specialist surveys were very similar with only minor differences in the language used. Interviews took approximately 17 minutes to complete and were collected from mid-February to early March 2023.

The 2023 plan sponsor findings include 304 plan sponsors, categorized as follows:

The 2023 DC specialist findings include 205 specialists, categorized as follows:

Similar to prior years, results shown for total plan sponsors were weighted to DOL plan counts provided by Voya ($1M to <$5M: 75%/68% [2021/2023], $5M to <$25M: 20%/25%, $25M+: 6%/7%) Total DC specialist data were weighted to the natural distribution of specialist focus (heavy focus vs. emerging) as determined by survey screening in prior years (heavy focus: 27%/27%, Emerging: 73%/73%).

Participant survey

Voya Consumer Insights & Research assisted Voya IM with the development, execution and analysis of the retirement plan participant survey. This survey was crafted to complement the plan sponsor and DC specialist surveys conducted with Brookmark Research. An online survey was conducted among 500 benefits-eligible, employed Americans who are actively contributing to their employer-sponsored retirement plan.

Additional screening criteria included:

- U.S. residents, ages 18+ (n=337 ages 18–49, n=163 ages 50+)

- Mix of employer sizes (companies with fewer than 25 employees excluded)

- Nat. rep. sample: Balanced by age and gender, while controlling for pre-retiree sample