Our long-term return expectations serve as key inputs into strategic asset allocation for multi-asset portfolios and provide context for shorter-term forecasting.

Foreword

Each year, the Voya Multi-Asset Strategies and Solutions team crafts capital market forecasts for the upcoming decade. This process allows us to step back from daily market fluctuations and focus on long-term economic and financial trends that influence asset class returns and risks. These forecasts are crucial for setting our strategic asset allocations across multi-asset portfolios.

In our analysis, we examine a variety of macroeconomic and financial data series. For instance, we consider how expectations for the labor force participation rate might affect potential GDP growth. While our data do not specify the exact impact, the broader analysis helps shape our understanding of economic dynamics.

We also explore whether profit margins are likely to revert to the mean. Our analysis suggests that investments in artificial intelligence could lower the marginal costs of production and distribution, much like the IT revolution did. Furthermore, the advanced features of AI-enhanced products can justify premium pricing, thereby bolstering valuations. Given the transformative potential of AI investments, we believe profit margins may not simply hold steady but could in fact grow, supporting the existing high valuations.

To address the risks of relying on single-point estimates, we use blended estimates that combine our base-case forecasts and an alternative macroeconomic scenario. This technique ensures that our forecasts remain balanced—preventing over-optimism or excessive pessimism—while also incorporating dual risk estimates that may enhance the resilience of our portfolios.

Currently, the U.S. economy is transitioning towards below-trend GDP growth, influenced by previous Federal Reserve tightening, stricter bank lending standards and a stronger dollar. We expect these factors will lead to looser labor market conditions and continued moderation in wage and price inflation—which should, in turn, support further Fed rate cuts.

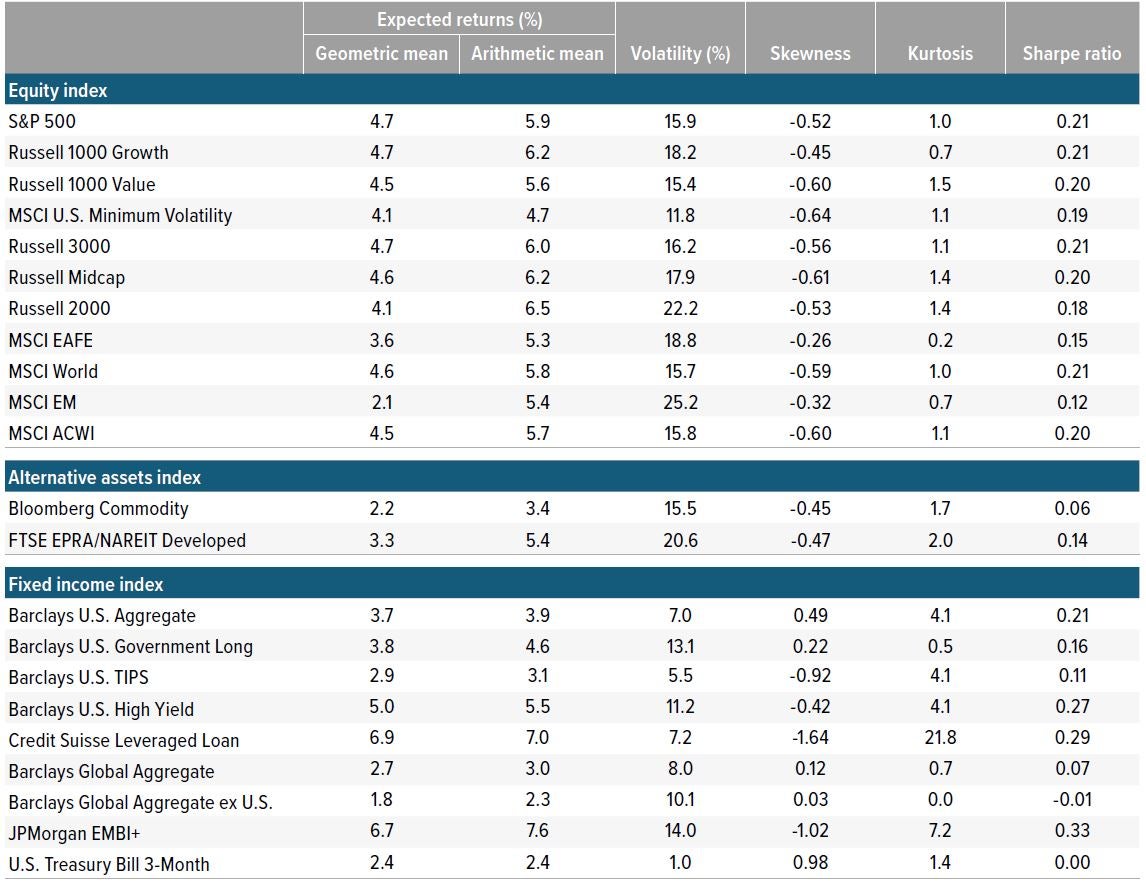

For the 10-year period (2025–2034), higher valuations and lower risk premiums point to below-average expected returns for equities. Our bond outlook has declined from our previous 10-year forecast due to lower starting yields versus the third quarter of 2023. However, we expect returns for both stocks and bonds will generally outpace inflation, offering attractive opportunities for asset allocators to generate alpha across and within asset classes, leveraging our strategic insights.

We hope this report will serve as a valuable tool in your decision-making process, and we wish you a prosperous 2025.

Summary of findings

Our Capital Market Assumptions (CMA) 2025 report details our research on asset class returns, standard deviations and correlations over the 10-year horizon from 2025 through 2034. These estimates represent key inputs into strategic asset allocation decisions for our multi-asset portfolios and provide context for shorter-term macroeconomic and financial forecasting.

Our base-case forecasts are informed by low potential gross domestic product (GDP) growth, reduced labor supply and elevated inflation. To avoid using a single-point-estimate forecast, we also incorporate an alternative scenario reflecting slightly better (or worse) macro inputs. Similar to last year, our alternative scenario is based on marginally higher productivity and a lower terminal federal funds rate.

Key takeaways:

- The next decade will likely be characterized by returns below historical averages across all major asset classes.

- Developed market equities are likely to deliver mid-single-digit returns, with the U.S. stronger than most other comparable markets.

- Emerging market equities should underperform developed markets, with higher expected volatility.

- Bond return assumptions have declined from last year, remaining in the low single digits, assuming moves in bond term premiums and real interest rates will cap the upside return potential of fixed income assets.

As of 09/30/24. Source: Voya IM. Forecasts are subject to change.

A note about risk

The principal risks are generally those attributable to stock and bond investing. The value of an investment is not guaranteed and will fluctuate. Equity investments are subject to market, issuer and other risks. Market Risk: Securities may decline in value due to factors affecting the securities markets or particular industries. Issuer Risk: The value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. Bonds are also subject to Market and Issuer risk, as well as interest rate, credit, prepayment, extension and other risks. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Interest Rate Risk: When interest rates rise, bond prices fall; bonds with longer maturities tend to be more sensitive to changes in interest rates. Foreign securities: Foreign investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic. These risks are generally intensified in emerging markets. Additional risks include, but are not limited to: Other Investment Companies’ Risks, Price Volatility Risks, Inability to Sell Securities Risks, Securities Lending Risks, Investment Model Risks, Liquidity Risk and Market Capitalization Risk.