The economy’s impressive resilience has helped markets shake off fiscal and geopolitical uncertainties. But while it’s business as usual for some sectors, others are facing a panoply of new challenges, compounded by the accelerating AI revolution. Our experts take a look at how to play this complex new landscape.

Watch the latest CIO Roundtable: The New Divergence Webinar Replay, hosted by Eric Stein, CFA, Chief Investment Officer.

“April is the cruelest month,” wrote TS Eliot in the opening of The Waste Land. He wasn’t talking about post-Liberation Day 2025 in the U.S. financial markets, but it sure felt like it. Imagine going back in time and telling your April 8 self—the one who had just watched the S&P 500 close at 4,982—that with May’s arrival, the index would march back up to 6,000 in almost a straight line. Past You may have scoffed. Yet here we are. But the events year to date are not without effect. Tariffs, continued high rates, a weaker dollar, significant federal policy shifts, and an increasingly stretched lower-income consumer are creating all-new obstacles for some sectors and opportunities for others. And that’s before factoring in disruption from artificial intelligence (AI). In this CIO Roundtable, our panel is broadly sanguine about U.S. economic prospects. But ask them to talk about investment ideas and the discussion gets very granular. (Solar ABS1 , anyone?) This is a market environment where active investing will be critical to outperformance—we’re seeing assets priced for perfection on the one hand, and things that are cheap for a reason on the other. We would love to hear what you’re thinking, too, and I look forward to more conversations as the market continues to keep us on our toes. Eric Stein, CFAChief Investment Officer |

After the rollercoaster, what’s next?

Eric Stein: So much has gone on over the past three months, our last meeting feels like an eternity ago. What’s your impression of what we’ve just been through—and where we’re going?

Barbara Reinhard: April 9 was an emotional bottom for markets. It looked like tariffs had passed a point of no return and the U.S. was heading for an economic cliff. However, while dislocations in markets can be vicious and painful, they don’t tend to repeat.

Our team looked back at what bottoms mean for equity markets, and found that, historically, if equities have a 20% correction, there’s only a 12% chance of having another 20% correction in the next 12 months.2 That’s a very low probability. To us, it means that unless there’s a true global shock, equities are not likely to go through another major downturn this year.

“Unless there’s a true global shock, we’re not likely to go through another major downturn this year.”

Sean Banai: It feels like everything is being discounted right now. Anytime Trump says something, the markets move a little bit, and then everyone moves on. This tells me the market has become more accustomed to the headlines.

Stein: Why do you think that is?

Banai: There’s so much money out there chasing fewer investable assets. Government debt has gone up significantly, but non-government investable assets have gone down. That’s why we’re not seeing the kind of volatility you’d normally get in this environment. I think it would take quite a few earnings misses to trigger a big downturn in the markets.

Reinhard: Exactly. We don’t see a reason to sell into equity rallies at this point. Valuations are very full, but corporate earnings are solid and margins are strong. Moreover, we’ve seen positive U.S. earnings revisions for the first time in over a year. In our view, U.S. companies look like they’re going to grow into these high earnings expectations.

It’s important to have realistic equity market expectations for 2025, after back-to-back years of 20% gains. But even so, we see some positive developments. Inflation looks relatively contained, labor markets are benign, and consumers are spending.

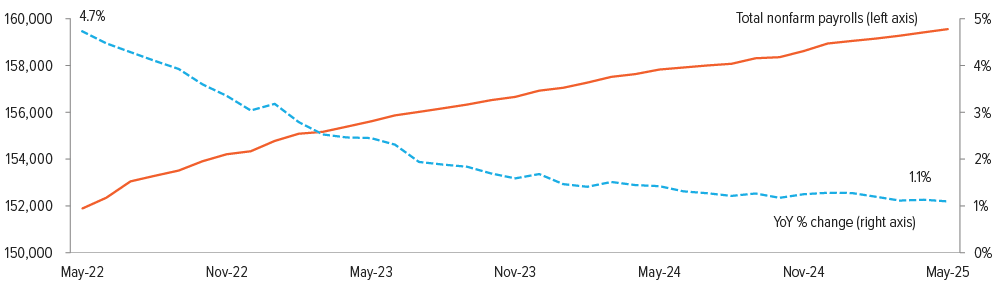

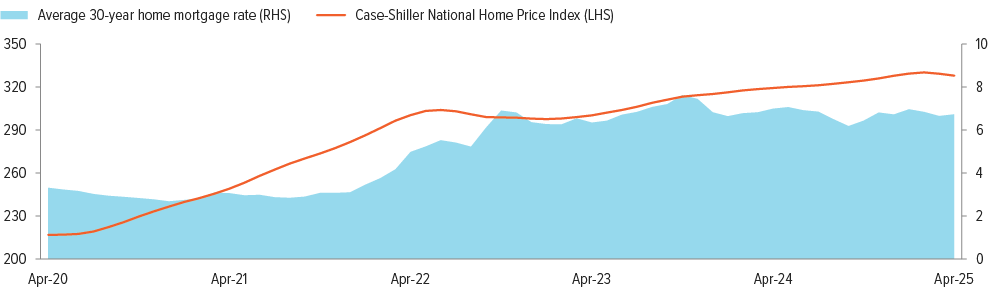

As of 06/24/25. Source: FRED.

Stein: Dave, the securitized sectors often provide some very differentiated insights on what’s going on in the economy versus the broader corporate bond and equity markets. What are you seeing?

Dave Goodson: As Barbara said, April’s “emotional bottom” was distracting for everyone in the markets. As a fundamentally oriented investor, it was hard to position around. But now that fog is clearing, and we can look to some of the more traditional ways we get comfortable with taking risks in the securitized market. For example, labor is interesting right now. We see it as softening, hitting the American consumer pretty squarely, which has big macro implications.

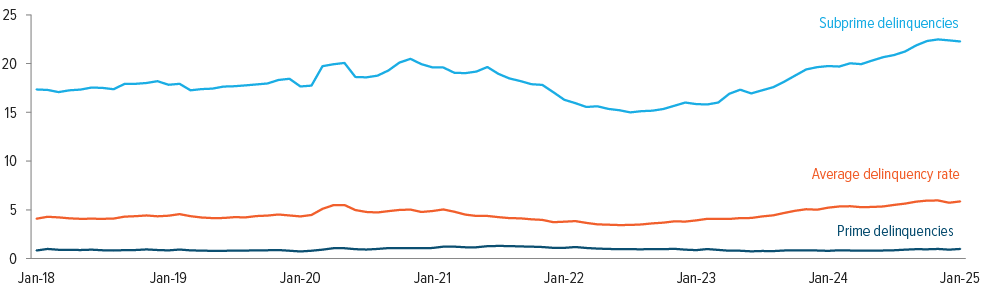

At a high level, consumer credit is a very strong story. But if you peel back the onion, there are some concerning parts. Certain cohorts in our society are hanging on by their fingernails. And the volatility in prices and incomes has put these parts of the consumer base in harm’s way. That is very real. We are taking selected risks in consumer debt, helped by all the income gains we’ve enjoyed the last five years, but it’s an area that bears watching.

“Certain cohorts in our society are hanging on by their fingernails, and the volatility in prices and incomes has put them in harm’s way.”

As of 04/02/25. Source: Kansas City Federal Reserve. Rates are weighted by outstanding credit card balance. Delinquency refers to balances 30+ days past due.

Stein: Kristy, how do things look through an equity lens?

Kristy Finnegan: It certainly seems like there’s an increasing bifurcation between high- and low-income consumers. While there are signs that the low-income consumer is even more stretched, overall consumer spending remains okay, supported by upper-income consumers. The fiscal policy as it’s currently laid out won’t offer any reprieve for those low-income consumers, either. But employment remains alright, so for the time being it’s not terrible.

Goodson: I’d also keep an eye on the effect of student loan repayments, which can be a huge additional burden on at-risk consumers. TransUnion numbers indicate about one in three federal student loan borrowers are at risk of default, up from one in five in February. And the Department of Education started going after delinquent borrowers’ wages again at the beginning of last month.

Fedwatch: The future of interest rates

Stein: Barbara, how do you think the Fed will react to this economic landscape? It’s not an easy one to navigate.

Reinhard: I think the Fed is taking a wait-and-see approach. Thanks to Covid, companies have a better playbook for dealing with supply chain issues and tariffs. Sure, tariffs are far more sweeping, and we’ve got a couple of big flash points coming: the first 90-day reprieve expires July 9, and the China tariff reprieve expires August 10. But the Administration seems to be in de-escalation mode. That is good news.

If there is an inflation blip because of tariffs, we think it’ll be short-lived because it will pinch demand quickly. The consumer doesn’t have as much extra discretionary cash in their wallets as they did in 2020-2021.

Banai: All the economic stressors today are policy driven, not economy driven. That makes it harder for the Fed to react. Because if they do react, it could cause the yield curve to steepen significantly, which could eliminate the benefits of a cut. We’ll see what happens with the Iran conflict—if oil prices go higher, that could be a problem.

“All the economic stressors today are policy driven.”

Reinhard: The high in U.S. crude oil prices over the past 12 months has been about $85. We think crude oil prices would need to double in a one-year time period to really get the economy heading toward recession.

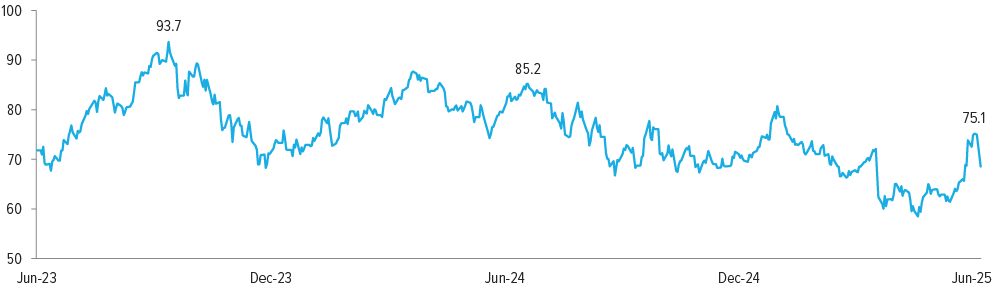

As of 06/24/25. Source: FRED, MarketWatch.

Banai: I think GDP growth will stay above 1% unless the tariffs are fully implemented, which could push growth down to 0.5%. Inflation is going to continue to slow down, and even if you get some inflation pressure on goods, it will be offset by slowdowns in housing price appreciation—which we’re already seeing.

Goodson: Yes, the Case-Shiller Index turned negative month on month in March, along with three other indexes I follow. Within the top 100 metropolitan statistical areas (MSAs), around 30 are now down on a year-on-year basis.

This leads me to believe we’re going to have another year of really low housing-related activity. And I expect home price appreciation to measure negative on a nationwide basis by the end of the year—not to a disruptive level, but enough to where it’ll raise some eyebrows and it will certainly be on the Fed’s radar. That’s not great for the economy, because household formation is such a key pillar of economic growth.

“I expect home price appreciation to measure negative by the end of the year.”

As of 06/24/25. Source: FRED.

Stein: Cards on the table—how many Fed rate cuts this year?

Reinhard: I think they’re going to do one.

Banai: One cut.

Jon Kaczka: Notwithstanding Trump’s comments that he will shift his immigration crackdown to avoid areas that are getting hit hard, such as hotels and farms, we know that payrolls are going to be slowing. And when that happens, it’s going to create a lot of noise. Is the Fed going to be expected to jump in and cut, or is it just the supply side that’s weakening? I agree it’s likely to be one cut this year, though.

Goodson: From a risk appetite perspective, I am not sensitive to whether it’s one or two.

Stein: At the end of 2026, where do you see the fed funds rate?

Reinhard: The current policy is modestly restrictive. It will be lower within two years. Our guess is anywhere between 50 to 100 basis points lower by this time next year.

Banai: If you look at Trump’s policies so far— and you can argue that the implementation could be better—I think they could be pretty positive for the U.S. economy in 2026. Between the tax extension and any tariff agreement that gives U.S. companies better access to international markets, 2026 growth could be pretty solid. And hopefully the uncertainties continue to go away. Of course, that makes Fed cuts harder to come by.

I’d say the fed funds rate will be around 3.75% by this time next year. The neutral rate is a lot higher than what the market expected. The only caveat here is who will be the nominee to chair the Fed, because Powell’s term ends next year.

“Trump’s policies could be pretty positive for the U.S. economy in 2026.”

Goodson: The ongoing slowdown in housing could cause some distortions in how consumers behave and the way they make decisions on household formation that perhaps we don’t understand fully right now. I’d rather see more in the way of cuts next year because of how it would help correct some of the current distortions in housing and, to a lesser degree, in commercial real estate.

Banai: I think that’s a risky view, because most people take mortgages on the 10-year part of the curve. So if there is an aggressive cut too early, you could have a significant steepening in the yield curve. We need to consider that cuts alone will not completely bring down rates.

Kaczka: One element that has reduced the rate sensitivity of the consumer has been the wide gap between the effective mortgage rate and current mortgage rate as homeowners locked in near record low rates. This gap remains wide—the average rate on outstanding mortgage principal is 4.05%3 and the current rate for new mortgages is around 6.75%—but has been narrowing of late. If it narrows significantly over subsequent quarters, it could become a headwind to the consumer.

Goodson: There’s a lot of volatility that’s been going on with rates, and that’s also embedded in the mortgage rate. So with a Fed that starts to cut in a controlled way, and not as a function of political messaging, we should see some volatility get pulled out of rate markets and that should also help the mortgage rate come down.

That would be good for growth, it would cause natural home turnover to pick up, and I’d feel better about household formation in that world. I’m not sure the mortgage-backed securities market is contemplating that benefit of a Fed potentially coming off the sidelines.

The dollar’s decline, and how to play it

Stein: The other big story of the past few months has been the falling dollar. Is it done depreciating? And what should investors do about it, if anything?

Reinhard: The dollar was very expensive at the start of the year and many market participants were long U.S. assets. The dollar weakness since then has taken some of the air out of that. I don’t think the administration is going to do a lot to prop up the greenback.

That has two main effects. First, the U.S. dollar decline has been a boon for international investors. Emerging market bonds had their single biggest inflow ever last week.4 While EM currencies have had some relative strength, they benefit greatly from a weaker dollar on the translation effect5 and from the fact that their dollar-denominated debt is now 7% cheaper.

Second, there’s been a broadly incorrect narrative that the U.S. is going to be left behind, and that the Europe is the place to be. It is not well known that the U.S. has been outperforming Europe since late April.

We think U.S. large caps and emerging markets are probably the best places to be. Smaller companies are feeling the brunt of this modestly restrictive monetary policy, and, unless rates move lower, they could continue to struggle in the near term.

“There’s been a broadly incorrect narrative that Europe is the place to be. It is not well known that the U.S. has been outperforming Europe since late April.”

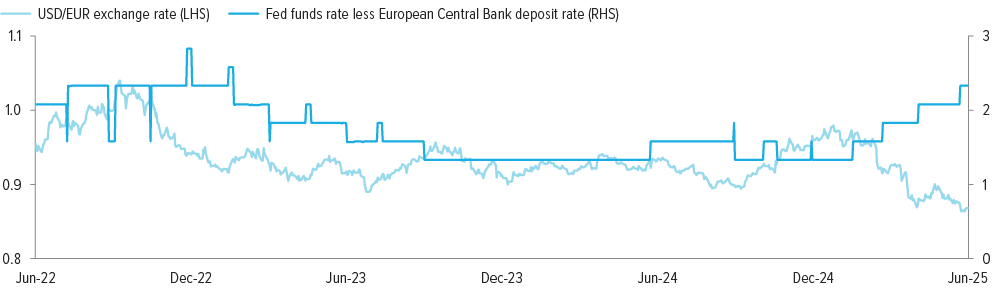

As of 06/24/25. Source: FRED.

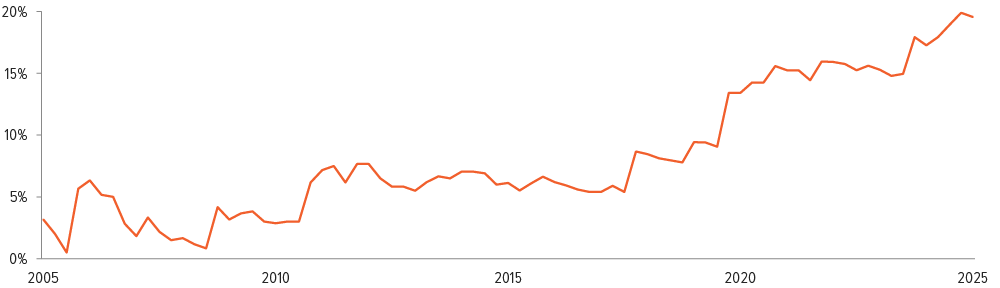

Kaczka: The way we’re thinking about it is that the U.S. exceptionalism trade is becoming more bifurcated. Even so, I looked at the number of double-digit revenue growers in the Nasdaq-100 versus the STOXX. Growth companies are inherently expected to exhibit stronger fundamental growth metrics than broad indices, but the spread between the percentage of U.S. high growth large caps and European ones has grown from 5% to 20% over the past decade.

As of 06/24/25. Source: Voya IM, Bloomberg.

Stein: Is the dollar likely to stabilize soon?

Kaczka: There’s a lot of pessimism priced into the dollar, and I think it has further to go, but the highest velocity moves are probably behind us. A lot of larger institutions have already released their hedge ratios, and while this a theme that will likely play out over several quarters, some have already shown sizeable shifts. If we’re talking about neutral rates stopping closer to 3.75% in the U.S. and the European Central Bank’s neutral rate closer to 1.5% at some point, that will move to halt that precipitous decline in the dollar that we’ve been seeing.

“There’s a lot of pessimism priced into the dollar, and it likely has further to go, but the highest velocity moves are probably behind us.”

Stein: So at some point the negative carry on the hedge ratio will outweigh people just trying to get out of dollars because they’re worried about a massive dollar decline.

Kaczka: Yes. And to Sean’s earlier point, if some of the policy uncertainty starts to subside, then that gives investors more confidence in retaining dollar assets and/ or not hedging the exposure completely— especially if you continue to see U.S. equities appreciate.

Stein: It’s like fiscal issues. Traditionally, we think of them manifesting through the long end of the bond market, but the dollar is another mechanism for the fiscal issues to play out. I think there’s a lot of investors that don’t want out of U.S. assets, but they do want to cover their exposure to the dollar.

Hunting for value in 2025’s markets

Stein: Let’s dig into the micro now. Kristy, what looks good from a growth standpoint—and what doesn’t?

Finnegan: The AI trade is shifting from being mostly on the semiconductor and infrastructure side, to now include infrastructure software. Whether it was Oracle or Snowflake, or even some of the comments Microsoft made around its Fabric business, we’re seeing enterprise IT accelerate spending towards modernizing their data infrastructure as a precursor to implementing more customized AI strategies. We believe this inflection is still in the early stages.

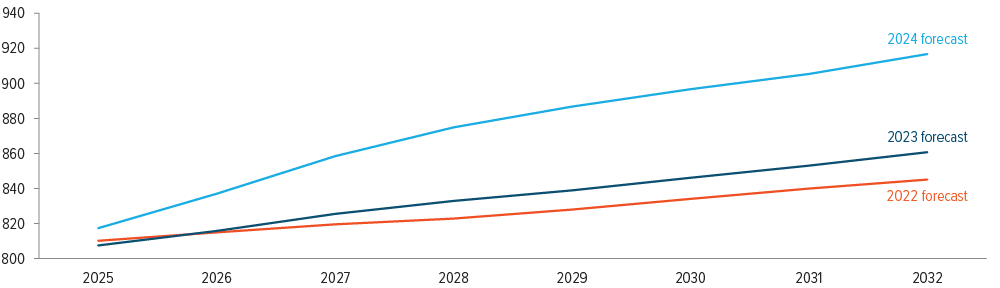

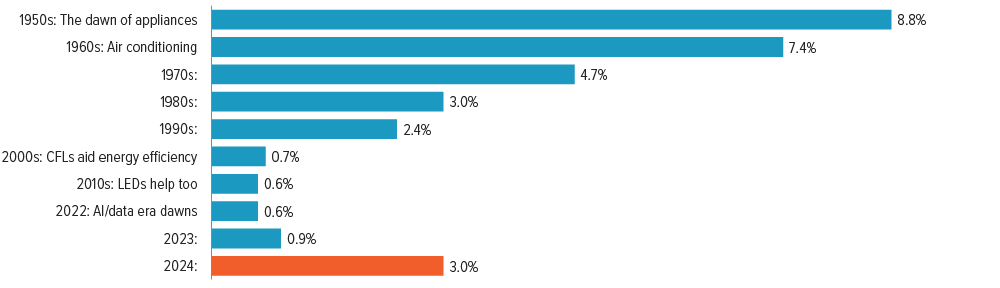

On the infrastructure side, demand for power is increasing on the back of the growing number of data centers being built right now and expected for next year. The U.S. Energy Information Administration just increased its electricity demand expectations for 2025 and 2026 by a couple of points.

That is all being driven by this AI trade, and it seems as though utilities are behind the curve on that. While those names have rebounded a fair amount and the valuations are not as attractive as they were, we feel we’re still in pretty early innings on the power story.

The aerospace and defense business is also attractive right now. It’s a space that has been in recovery, but both from the aftermarket perspective, as well as the planes coming back into production, there’s multiple tailwinds for that group. They have great pricing power, so they can handle tariffs.

Stein: And what about from a value perspective?

Finnegan: Oof. There’s what looks attractive from a valuation perspective and there’s what we like, and those aren’t always the same. The sectors with the most attractive valuations right now are the ones exposed to the most policy uncertainty, and this requires careful, selective investing.

Health care is a good example. The managed care and Medicaid-dependent parts of it are under acute fiscal budget pressure, but there are other health care segments where we believe concerns are overdone. We see potential for superior returns in the med tech utilization, GLP/ obesity, and tools/bioprocessing areas.

On the pure value side, we’ve been looking at analog semis and some hardware names that could benefit from some of these trends that aren’t necessarily priced in. But I would caution that valuations across the board have gone pretty high again, and areas that are inexpensive are generally cheap for good reason.

“The sectors with the most attractive valuations right now are the ones exposed to the most policy uncertainty.”

Stein: Dave, you have all these different submarkets within the broad rubric of securitized. Where are you seeing value?

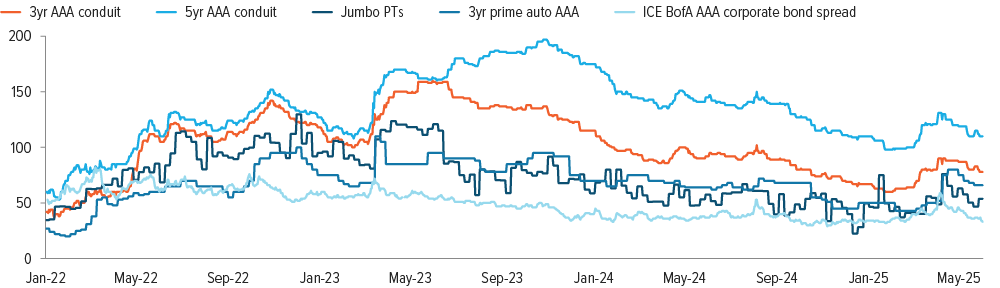

Goodson: I think we all have the sense across our markets that stuff has traded very well since April. Securitized took a little longer to catch up to the other markets, but, even so, things are feeling on the rich side for us.

There are only a couple of places where we think there is still measurable excess return to be made at the sector level. Commercial mortgage-backed securities (CMBS) is the first. It is still very early-cycle recovery mode at this point, but we’re actually seeing risk appetite for offices— granted, a narrow subset of offices.

Beyond that, it’s tiny little micro trades. For example, solar ABS registers to us as incredibly cheap right now on the back of Sunnova and Solar Mosaic going bankrupt, which has translated into much wider spreads across the solar space. Within the CMBS universe, data centers have lagged big time. They’re very cheap. I think there is still some mistrust in our space, given the DeepSeek news.

As of 06/20/25. Source: Voya IM. Commercial mortgage-backed securities (CMBS) is represented by three- and five-year conduits, which are bonds backed by pools of of similar commercial mortgage loans. Jumbo PTs are non-agency residential mortgage-backed securities (RMBS) backed by groups of residential loans, usually on high-cost or luxury properties, that are larger than the Federal Housing Finance Agency will allow agencies (such as Fannie Mae or Freddie Mac) to purchase. These loans tend to be owed by the highest-quality mortgage borrowers. Three-year prime auto are bonds backed by pools of similar automotive loans, and represent the consumer asset-backed securities (ABS) sector. The ICE BofA AAA bond spread tracks the performance of all U.S. dollar denominated investment grade rated corporate debt with a rating of AAA (the highest rating, denoting the lowest perceived credit risk) publicly issued in the U.S. domestic market. For more information, please see our Brief Guide to Securitized Credit and Glossary of Securitized Credit Terms.

Stein: What about the flipside? Are there pockets of distress or concern from an underlying credit perspective?

Goodson: There are two places. One would be collateralized loan obligations (CLOs). Spreads are really tight—in the top 10% of their range versus the past five years. At the same time, defaults have started to pick up in loans. Combine that with the lower-growth outlook, and that pickup is likely to continue. We’re not saying exit the space, but we do think it pays to be more defensive at this point, moving up the capital stack.

The other place is we have big parts of our market collateralized by lower-income cohorts. We have serious concerns about this space. Even with delinquencies reaching all-time highs in credit cards, the market has just invested right through all of that, pushing areas like subprime auto back to year-to-date tights.

Banai: We still like CLOs. We only look at high quality, and CLOs are still providing a good spread relative to corporate bonds, which is our main yardstick. This is different from Dave, who is comparing CLO spreads to similar risk in his other securitized subsectors, which tend to have wider spreads than corporates.

We agree with Dave that CMBS looks very attractive. We have a pretty large allocation there, and, if things get wider, we’d look to add more. We’re also talking to Dave’s team a lot about solar. Everything got wider, not just the lender that went bankrupt. The team did a great job avoiding the risky names, and that’s created opportunity for us to increase our allocation.

Stein: Thank you. We’ll see how these stories continue to develop for the rest of 2025, but I for one am happy to look forward to a less volatile second half of the year.