Securitized credit is a popular, if complex, fixed income allocation. Here’s where to begin.

What is securitized credit?

Securitized credit refers to publicly traded bonds that are backed by pools1 of loans, mortgages or other cash-flow-generating contracts.

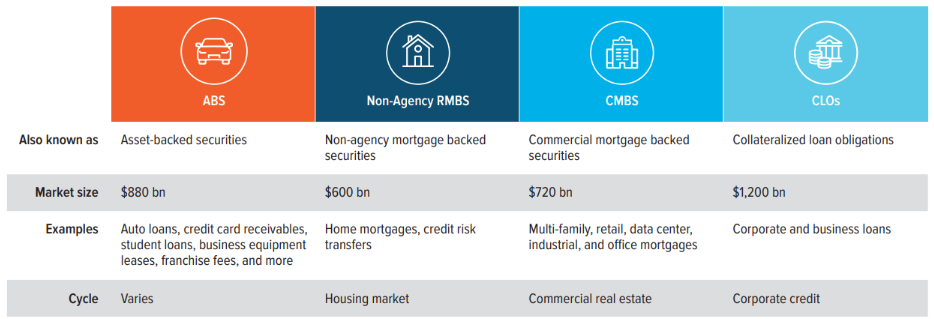

These pools consist of similar types of assets for each specific bond: a pool of auto loans serves as collateral2 for an Auto Asset Backed Security (ABS), credit card receivables collateralize Credit Card ABS, residential mortgages collateralize Residential Mortgage Backed Securities (RMBS), commercial mortgages collateralize Commercial Mortgage Backed Securities (CMBS), and business loans back Collateralized Loan Obligations (CLOs). These are more common types of securitized credit bonds, but any type of asset that has a recurring cash flow can be securitized (Exhibit 1).

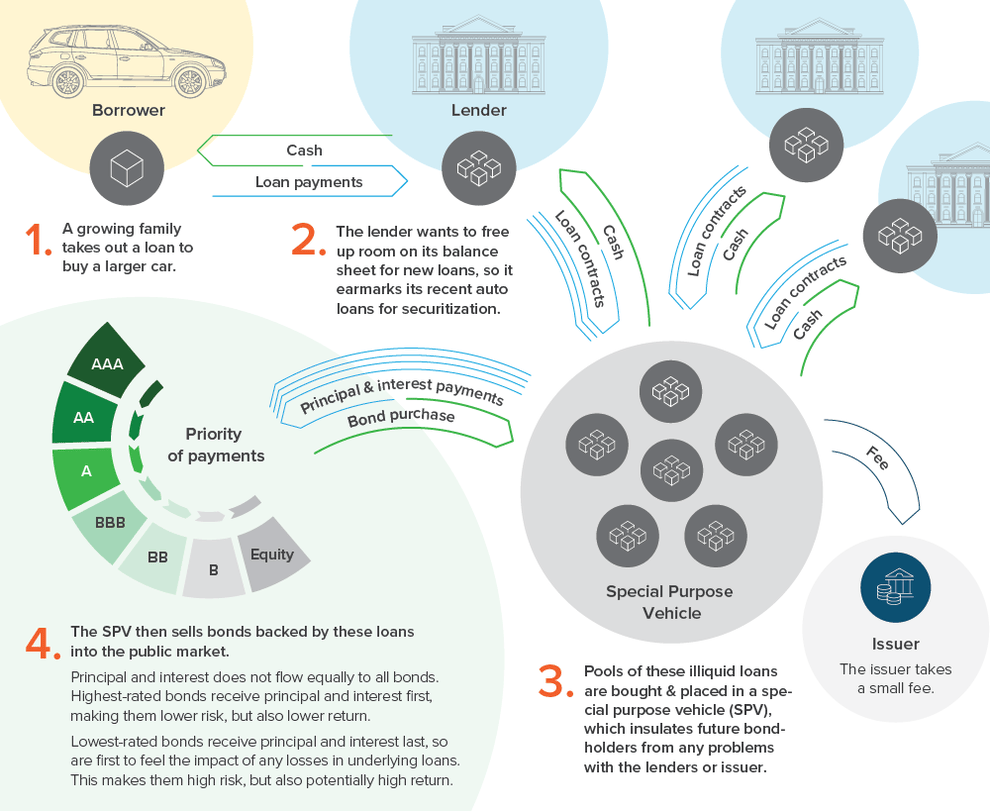

Securitized credit bonds are like any other type of bond in the sense that the credit risk (the likelihood bond holders are repaid) is ultimately tied to the creditworthiness of the borrower. A key difference is that for most securitized credit sectors, there are multiple borrowers associated with a particular bond, as opposed to just one (Exhibit 2).

Source: Voya IM. For illustrative purposes only.

There are two other key differences between securitized credit and traditional bonds:

How securitized is different: tranching

The pools that back securitized credit bonds are typically sliced up into different classes called tranches. 3 Each tranche has its own credit rating,4 with investors in higher-rated tranches paid first—which means they are exposed to less risk.

Because tranches absorb any default-related losses from the bottom up, lower-rated tranches (which are exposed to more risk) pay investors a higher interest rate. This can be referred to as subordination or a capital structure.

Tranching allows securitized credit bonds to appeal to a wider variety of investors, offering different risk levels and maturity options to best suit the goals of various portfolios.

For example, banks and insurers are typically attracted to the higher-rated tranches due to those tranches’ structural protections. Hedge funds, which are able to accept more risk, are typically attracted to the lower-rated tranches due to their higher return potential.

How securitized is different: deleveraging

Securitized bonds tend to get safer with age, through a process known as deleveraging. Unlike traditional corporate bonds, which pay periodic interest during the bond’s life and do not repay principal until the end, the loans backing most securitized credit bonds repay both principal and interest every month.

This means that each month, the amount of debt at risk for a particular securitized bond goes down—in other words, the bond deleverages.

What are the main benefits and risks of securitized credit?Adding securitized credit to a fixed income portfolio has two primary potential benefits: Yield: Historically, securitized credit has offered higher yields for the same level of risk than corporate bonds, due to securitized credit being more structurally complex. Diversification: Most major fixed income indices are concentrated in corporate bonds and lower-yielding government guaranteed bonds. Meanwhile, securitized credit offers investors more broad and diversified exposure. For example, CMBS and RMBS provide investors exposure to real estate, while ABS provides investors exposure to consumer credit. This is a primary reason why securitized credit exhibits a low correlation to other fixed income assets, helping improve risk-adjusted returns in multi-sector/multi-asset portfolios. Similar to other kinds of bonds, securitized credit carries credit risk and interest rate risk. Credit risk may be mitigated by investing in higher-rated tranches, but fluctuations in interest rates may cause bond prices and interest income to go up or down. Some securitized credit bonds, especially those based on residential mortgages, can also carry prepayment risk, which tends to be higher in a falling rate environment. Prepayment may be a risk or a benefit depending on the bond price at the time. |

A note about risk: The principal risks are generally those attributable to bond investing. Holdings are subject to market, issuer, credit, prepayment, extension, and other risks, and their values may fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. The strategy invests in mortgage-related securities, which can be paid off early if the borrowers on the underlying mortgages pay off their mortgages sooner than scheduled. If interest rates are falling, the strategy will be forced to reinvest this money at lower yields. Conversely, if interest rates are rising, the expected principal payments will slow, thereby locking in the coupon rate at below-market levels and extending the security’s life and duration while reducing its market value.