As oversaturated mega caps start to lag, it may be time to think small. With historically strong performance during economic recoveries, plus greater relative value and growth opportunities, small caps are ready to have their moment.

What volatility is telling us

The tech-heavy Nasdaq 100 has just had one of its biggest months of underperformance against small caps since the dot-com bubble. In July, it fell a whopping 11.7% against the Russell 2000—and the markets have grown only more volatile since.1 Is this a sign that the prolonged technology mega cap bull run is ending?

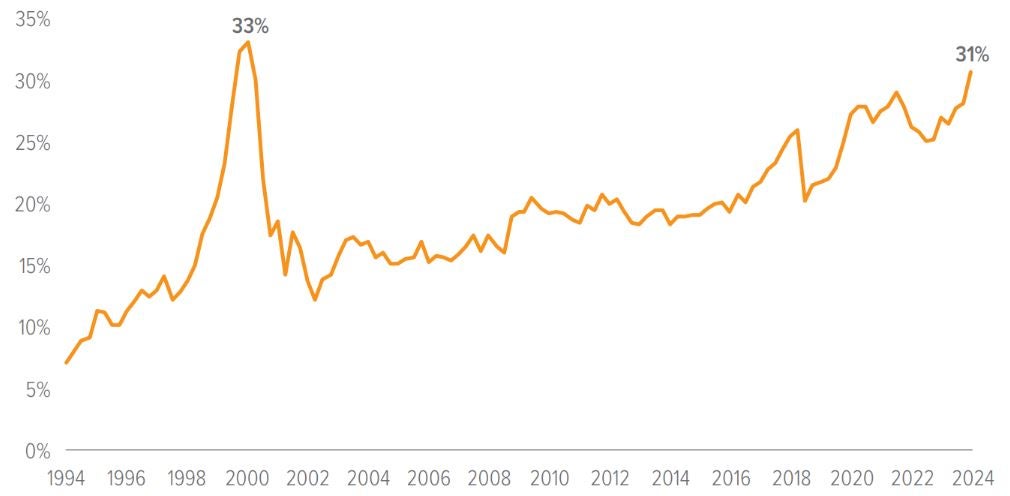

At present, the market’s 10 largest stocks represent 33% of the Russell 1000 by market cap. That’s makes this the most highly concentrated market in over 30 years (Exhibit 1). At these levels, the ownership of key mega cap stocks may have simply reached a saturation point.

Investors may be skeptical about adding further exposure to mega caps, especially as some of the largest companies have recently demonstrated relative fatigue after multiple years of strong share price performance. But can be hard to give up on stocks that have done so well, for so long.

The market’s current volatility can be seen as a natural result of the beginnings of a sentiment shift. Early money is already rotating out of mega caps and broadening out among sectors and sizes, with investors increasingly attracted by the prospects of more attractive valuations (relative to history) further down the market cap spectrum. Should you follow?

As of 06/30/24. Source: FactSet, Voya IM.

Good things may come in small packages

Due to their higher average growth potential, small cap stocks have historically outperformed their larger counterparts during economic recoveries—a key consideration as the Federal Reserve edges ever closer to a cutting cycle.2 Small companies tend to be more nimble, able to adapt quickly to changing market conditions.

Additionally, small caps are often more domestic-focused and therefore less affected by global market fluctuations and geopolitical risks. With a U.S. election looming and multiple global conflicts in progress, small caps can potentially provide a greater degree of insulation in uncertain times than mega caps. Moreover, small cap equities offer diversification benefits and the possibility of discovering undervalued opportunities, which mega cap stocks are unlikely to provide. Small caps’ lower market capitalization also mean that positive developments can have a more significant impact on their stock prices.

For investors willing to tolerate higher risk, we believe that small cap stocks offer value, diversification, and growth opportunities, especially compared to mega caps in the current market.

As of 06/30/24. Source: FactSet, Voya IM.

The concentration complication

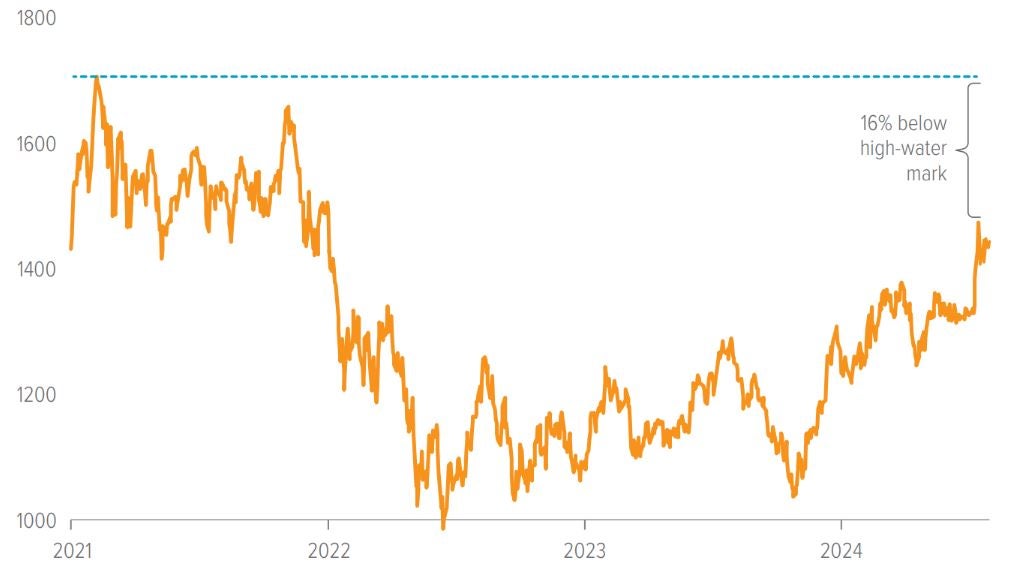

Technology stocks have been at the epicenter of the Russell 1000’s multi-decade advance. Taken as a sector, tech now makes up 31% of the index’s weight (Exhibit 2). Its dominance over the years can be attributed to several factors:

- Rapid advancements in artificial intelligence (AI), including machine learning, have spurred significant innovations and applications across multiple industries, enhancing productivity and creating new business opportunities.

- The Covid-19 pandemic accelerated digital transformation, increasing demand for solutions in remote work, e-commerce and other areas.

- Low interest rates following the global financial crisis spurred investments from both the private and public sectors, fueling growth and development of technologies, while strong financial performance and expectations for outsized growth have attracted investors.

- Companies with technological leadership positions have demonstrated competitive advantages that are less likely to be eroded in the near term, boosting their market valuations.

The recent outperformance in other areas of the market suggest that many investors view the factors driving tech stock gains as slowing and/or fully priced in. Time will tell whether this rotation is simply a pause in the multi-decade advance of these tech goliaths—or the beginning of what some may deem a healthy pullback in favor of other market segments.

As money looks for new homes outside of Big Tech, there is one sector that offers a number of potential advantages in the current economic and geopolitical environment: small caps.

As of 07/31/24. Source: FactSet. Chart shows closing prices. Feb. 2021 high of 1726 was intra-day high. See index information at the end of this document.

A note about risk The principal risks are generally those attributable to investing in stocks and related derivative instruments. Holdings are subject to market, issuer and other risks, and their values may fluctuate. Market risk is the risk that securities or other instruments may decline in value due to factors affecting the securities markets or particular industries. Issuer risk is the risk that the value of a security or instrument may decline for reasons specific to the issuer, such as changes in its financial condition. More particularly, the strategy invests in smaller companies, which may be more susceptible to price swings than larger companies because they have fewer resources and more limited products, and many are dependent on a few key managers. |