We aren’t overly concerned about U.S. regional bank debt despite Moody’s ratings actions and several earlier high-profile bank failures. While we still favor money center banks over regionals, recent volatility has created openings to add positions selectively.

Highlights

- Wall Street had a fairly muted reaction to Moody’s August ratings actions compared with its response to the three banks that recently failed.

- Unlike those failed banks, most U.S. regional banks tend to be diversified institutions focused on traditional retail and commercial banking clients.

- To some degree, many financial firms are facing the headwinds that Moody’s is watching, including rising funding costs, unrealized securities losses and commercial real estate exposure.

Moody’s action against select U.S. regional banks didn’t move markets much

In early August, five months after the collapse of Silicon Valley Bank, U.S. ratings agency Moody’s took negative ratings actions against 27 U.S. regional banks. Wall Street’s reaction was fairly muted. Only one of the downgraded banks (M&T Bank Corp.) has meaningful issuance in the market, and it performed in line with other regional banks that had not been downgraded.

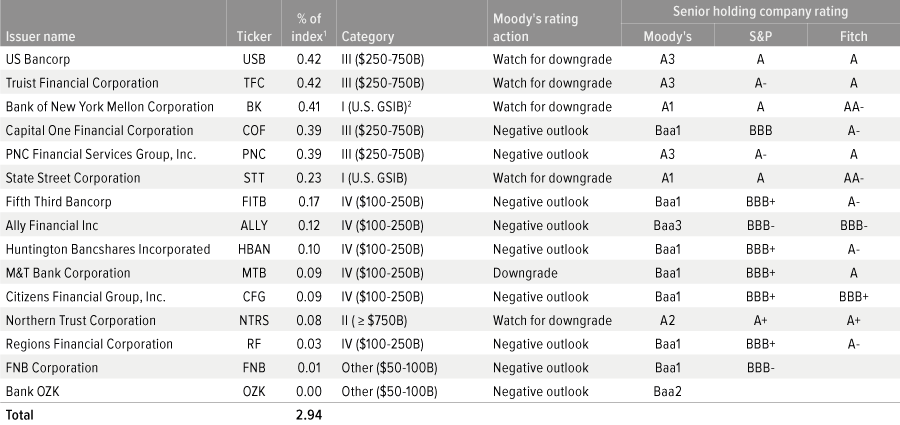

Importantly, Moody’s actions affected only 3% of the Bloomberg U.S. Investment Grade Corporate Bond Index, a widely used benchmark for managers of U.S. investment grade portfolios and a significant component of the Bloomberg U.S. Aggregate Index (Exhibit 1). Many of the banks flagged by Moody’s are relatively small and are not part of the investable universe of investment grade corporate bonds.

Ratings as of 08/16/23; index weights as of 07/31/23. Source: Bloomberg, Moody’s.

1 Bloomberg U.S. Corporate Index.

2 Global systemically important bank.

We remain cautiously optimistic on U.S. regional banks

Despite the sector’s troubles this year, we believe U.S. regional banks continue to offer investable opportunities:

- The three banks that failed earlier this year — Silicon Valley Bank (SIVB), Signature Bank (SBNY) and First Republic Bank (FRC) — had specific attributes that made them more exposed to bank runs. For example, a large percentage of their deposits were uninsured at the end of 4Q22: 93.8% of SIVB’s, 89.3% of SBNY’s and 67.4% of FRC’s. This made them vulnerable, as did the lack of diversification in their customer bases and FRC’s significant unrealized losses in its securities and loan books.

- By comparison, the remaining Category IV banks (those with $100–250 billion in assets) are diversified institutions focused on traditional retail and commercial banking clients. These institutions are not overly exposed to specific industry sectors of the economy, and their deposit bases are both granular and balanced in terms of insured versus uninsured balances.

- The regional banks are also not overly exposed to credit card lending and have less construction and development loans than during the global financial crisis. From our perspective, increased regulation is a headwind for earnings and equity returns, but it should be a positive for bondholders.

- We also take some comfort in the fact that capital returns to shareholders are likely to decrease in the near term, until the regionals understand the new regulations to be implemented. We believe that these rules will be implemented over a long period of time, which should also be a benefit to bond investors.

U.S. regional banks are not immune to trouble. If the economy deteriorates, we would expect higher credit losses in many of these institutions — a scenario that would likely materialize first in commercial and industrial loan books. The market’s primary concern today is in the commercial real estate (CRE) space (especially offices), but we believe that any losses would be a “slow burn,” occurring over an extended time frame.

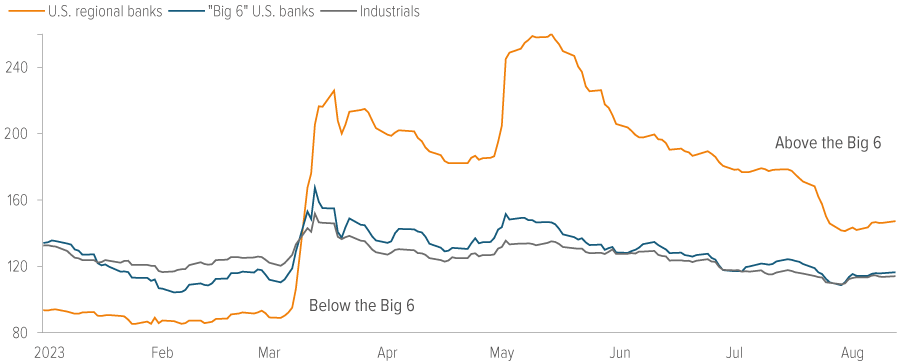

We continue to favor money center banks over regionals, although recent spread widening has improved the risk/return profile for certain superregional and Category IV banks (Exhibit 2).

As of 08/14/23. Source: BofA Global Research, ICE. Big 6 U.S. banks: Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, Wells Fargo. U.S. regional banks: Citizens Financial Group, Comerica, Fifth Third Bancorp, Huntington Bancshares, KeyCorp, M&T Bank Corp, PNC Financial Services, Regions Financial Corp., Truist Financial Corp., U.S. Bancorp, Zions Bancorp. Industrials are a sub-component of the Bloomberg U.S. Investment Grade Corporate Bond Index.

Moody’s watching headwinds for life insurers, REITs and non-U.S. banks

Moody’s said its ratings actions against regional banks were driven by several concerns, including rising funding costs, unrealized securities losses, low regulatory capital levels, commercial real estate exposure and increased regulatory pressures. This is a broad range of risks that all financial firms face to some degree, especially life insurers (which have both unrealized securities losses and CRE exposures on their balance sheets) and office REITs (which are directly affected by CRE exposure).

Apart from regional banks, non-U.S. banks are a constant target for potential rating agency actions, and over the long term they present added risks relative to U.S. peers. Specifically, they are often less profitable, and their USD-denominated bond valuations can be more heavily influenced by geopolitical events. However, on average, we believe non-U.S. banks that issue USD debt are better positioned than U.S. regional banks in the areas of interest rate risk, rising funding costs and exposure to CRE. As a result, they are likely less of a target for Moody’s on these specific headwinds.