ESG Investing: A Practitioner's Guide

Environmental, Social and Governance Investing

The ABCs of ESG investing

ESG refers to the “Environmental, Social and Governance” factors which may have a material impact on the companies in which we invest and the performance of an investment. ESG Investment Solutions, often referred to as Responsible or Sustainable Investments, are a set of broad terms meant to capture a range of approaches that attempt to align client values with investment objectives.

As a term, “ESG Integration” is often used interchangeably with other ESG or Responsible Investing approaches. However, while there are many similarities across Responsible Investing approaches, there are also important nuances investors should understand and consider:

Spectrum of ESG Approaches

How is ESG different from other responsible investing approaches?

The main difference between ESG Integration and other approaches is that the focus of ESG Integrated strategies remains on financial performance. The analysis of ESG factors is integrated with traditional financial analysis to enhance the understanding of a company’s potential risks and opportunities.

The driving philosophy behind ESG investing is that over the long-term, those companies with a strong sense of values and purpose that positively impact society and the environment are more likely to succeed, and as a result, may deliver better investment performance. In other words, companies that proactively address long-term environmental, social and governance trends will be better positioned to mitigate emerging risks and capitalize on new opportunities.

In other approaches such as Socially Responsible Investing (“SRI”) and Impact Investing, the primary focus and motivation is not necessarily financial performance only. For example, SRI strategies may actively avoid certain investment types to align with investors’ values. Examples of investments that SRI strategies avoid include companies that manufacture and distribute firearms or controversial weapons, as well as companies that produce alcohol, tobacco and other addictive substances. Additionally, there is an increasing set of exclusionary criteria including fossil fuels production, oil sands involvement, faith-based criteria, non-compliance with international standards such as the UN Global Compact or International Labor Organization standards.

Sustainable Investment or (Inclusion, Thematic or Impact Investing), takes a more direct approach and focuses on driving outcomes that have a measurable positive social or environmental impact alongside investment performance, or whose investment thesis is to find outperformance through a specific inclusion and focus on ESG issues. An example of impact investing would be an investment in a non-profit organization dedicated to clean energy—instead of evaluating the investment solely in monetary terms, the investment is viewed through the lens of its potential to positively impact the environment, such as the annual amount of greenhouse gas emissions avoided or carbon sequestered by preserving forest acreage in addition to any financial performance.

ESG in action: An example of integration

To better understand how ESG considerations are incorporated into the investment process, consider the analysis of an oil company. As an industry, oil producers are not likely the first companies that come to mind in terms of ESG. However, remember that with ESG Integration, the goal is not to exclude companies or limit an investment universe due to non-financial criteria. The goal is to use ESG principles to identify those companies across all industries that have the potential to deliver more attractive long-term investment performance because they are better positioned to navigate material ESG trends.

While oil producers generally are likely to have a lower absolute environmental score or increased risks due to climate change compared to other industries, there are characteristics among oil companies that differentiate them from an ESG perspective. For example, compared to an oil company with a strong safety record, a company that has a track record of oil spills has a relatively lower ESG score and diminished potential for delivering attractive long-term investment returns. Oil spills are awful for the environment—they also result in significant fines, lawsuits and legal costs that hurt the long-term financial performance of a company. Accordingly, all else being equal, an oil company with strong quality controls and a track record of no spills may represent a more attractive investment opportunity, not considering security price, compared to a company with poor quality controls and a track record of oil spills.

From a competitive standpoint, there are also several steps oil companies can take that simultaneously enhance their ESG profile and boost their potential for long-term financial gains. For example, renewable energy sources are taking market share from more traditional fossil fuels, a trend that is expected to accelerate in the years and decades to come as countries around the world commit to meeting the Paris Climate Accord or additional subsequent standards. Oil companies that diversify their business lines to capitalize on this trend not only reduce their negative impact on the environment, they position their organizations for long-term financial success and become part of the solution to global challenges.

Of course, if ESG principles help identify better investment opportunities, the question becomes: Then why are investors just starting to look at these factors now? The answer has two parts. The first is that to some extent, many investors have always considered ESG principles in their evaluation of investment opportunities—the term “ESG investing” is simply a framework to capture, evaluate and articulate this part of their investment process. However, while some investors may have considered ESG issues sometimes, ESG integration seeks to systematically consider ESG issues for all investment decisions in a documented fashion. The second, and much more significant reason, is that the world has fundamentally changed. Companies are increasingly focused on ESG because consumers are increasingly focused on ESG; every day we see ESG issues which are affecting companies in the real world.

This virtuous cycle, where consumers and citizens demand more from corporations and governments, creates a market environment where the companies most focused on ESG benefit more from higher consumer demand. By contrast, companies less focused on ESG are negatively impacted by weaker consumer demand and risk running afoul of regulations; which, due to increased demand from constituents, are stricter and more punitive for less-responsible companies.

As wealth shifts to the younger generation, ESG becomes mainstream

As a concept and investment approach, Responsible Investing is not new. Responsible Investing began in the 1960s, primarily with investors excluding stocks or entire industries from their portfolios as a way to express their values in their investment decisions. However, while Responsible Investing has been around for generations, it was never adopted on the scale we are witnessing today. One in four dollars invested in the United States now takes into account ESG issues, and inflows to ESG funds recently hit a record high.1

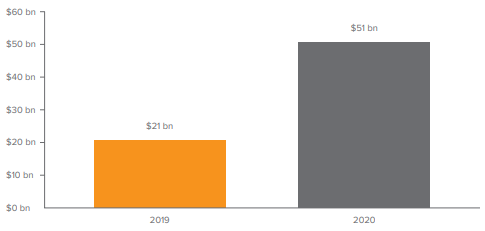

Inflows to sustainable funds hit record high

Inflows to funds investing in companies with positive Environmental, Social and Governance (ESG) practices more than doubled the 2019 total and reached a record high in 2020.

Source: Morningstar. Data as of 12/31/2020. Includes Sustainable Funds as defined in Sustainable Funds U.S. Landscape Report, Feb. 2020. Includes funds that have been liquidated; does not include funds of funds.

The U.S. is experiencing a $30 trillion intergenerational wealth transfer from baby boomers to their children. The soaring popularity of ESG investing represents a tectonic shift in human behavior and reflects how most younger people view themselves in relation to the world. Increasingly, younger generations in the U.S. want their actions to bring about positive change in the world and they want the connection to that change to be linear and transparent. As consumers, they can influence company behavior by the brands they choose to engage with. As citizens of democratic countries, they can elect political leaders who advance ESG initiatives through policy decisions.

How this younger generation chooses to invest its money is another very important part of the equation. A 2019 research survey conducted by Morgan Stanley showed that 95% of millennial respondents are interested in sustainable investing, up 9 percentage points from 2017.2 According to a February 2020 report from Deloitte, ESG-mandated assets in the U.S. could grow almost three times as fast as non-ESG-mandated assets and represent half of all professionally managed investments by 2025. In addition, an estimated 200 new funds in the United States with an ESG investment mandate are expected to launch over the next three years, more than doubling the activity from the previous three years.3

The rest of the world joins the U.S., or rather the U.S. joins the rest of the world

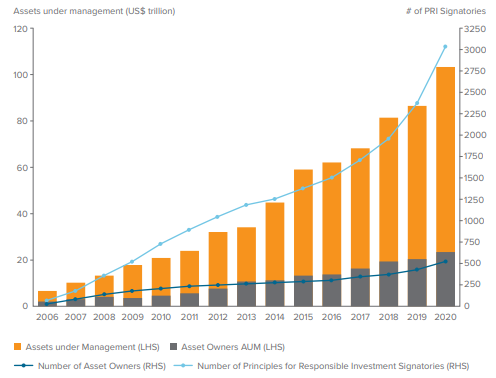

The Principles for Responsible Investment (PRI) is the world’s leading proponent of responsible investing. Its signatories account for U.S. $103.4 trillion as of March 31, 2020, representing 3,038 signatories. Asset owners and investment manager signatories are required to report on their responsible investment activities annually through the PRI Reporting Framework.

Source: Principles for Responsible Investment. As of 12/31/20

ESG ratings: Navigating ESG at the company and issuer level

There are over 100 organizations that provide ESG ratings and research on individual companies—this data is also referred to as “non-financial data.” Below is a list of common ESG factors these organizations use in their evaluation process. While each organization employs a slightly different ratings methodology, companies are generally assessed based on the materiality of each ESG factor in their industry. For example, pollution and waste carries a more significant weight for a coal company than it does for a software company. Additionally, the industry as a whole is moving towards standardizing material ESG factors and how companies disclose such data. The Sustainability Accounting Standards Board (SASB), the task Force for Climate Related Financial Disclosures (TCFD) and various European regulations are attempting to move toward a standardized set of ESG factors and required disclosures. This effort will continue to evolve with a real push towards uniform standards.

Common ESG Factors Used to Evaluate Companies

Environmental

- Climate Change Risk Exposure

- Carbon Emissions and Energy Use

- Resource Use: Water, Forestry

- Pollution and Waste

- Environmental Opportunities: Clean Tech

Social

- Diversity and Inclusion

- Labor Management

- Product Liability

- Stakeholder Opposition

- Social Opportunities: Finance, Healthcare

Governance

- Business Ethics and Fraud

- Ownership and Board

- Compensation, Accounting

- Corruption, Human Rights

- Anti-Competitive Practices

Below is a list of common ESG ratings organizations and a brief description of the process they employ to evaluate individual companies and the scope of their coverage:

- Bloomberg ESG Data Service – Collects ESG data for 10,000+ publicly listed companies globally and rates each company on a scale to 100. ESG data is integrated into Bloomberg Equities and Intelligence Services. Bloomberg ESG Disclosure Scores rate companies annually based on their disclosure of quantitative and policy-related ESG data.

- MSCI – Employs a rules-based methodology to identify ESG industry leaders and laggards across 7,500 companies (13,500 total issuers, including subsidiaries). MSCI rates companies on a “AAA to CCC” scale according to their exposure to ESG risks and how well they manage those risks relative to peers.

- Refinitiv – Provides ESG data and scoring on over 9,400 companies, both active and inactive. Also allows users to measure a country’s relative performance across each of the UN Sustainable Development Goals and sub-metrics.

- RepRisk – ESG coverage of 130,000+ public and private companies and 30,000+ infrastructure projects. Information includes a summary of RepRisk ESG analytics and metrics that capture and highlight the areas of ESG risk exposure of each company, for both two-year and a ten-year timeframes, as well as qualitative research that details all the individual ESG risk incidents related to each company since 2007.

- Sustainalytics – Provides ESG ratings and research on 4,000+ companies, ranking companies on a scale of “Low ESG Risk to Severe ESG risk.”

Conclusion: ESG in Practice

Demand for strategies that attempt to align client values with investment objectives is expected to soar. While performance of these strategies has long been under scrutiny, the COVID-19 market dislocation provided the ESG investment category with its first real test—one it passed with flying colors. According to Morningstar, in 2020, three out of four sustainable equity funds beat their Morningstar Category average, and 25 of 26 ESG equity index funds beat index funds tracking the most common traditional benchmarks in their categories.4

While the investment management industry has responded to growing ESG demand with a solid foundation of strategies and indices, more product innovation is on the way. As ESG ratings become more standardized and more widely adopted, having a broad understanding of the ESG space will be a critical component of future investment success.

1 Global Sustainable Investment Review, Global Sustainable Investment Alliance, 2018.

2 Source: Morgan Stanley, Sustainable Signals: Individual Investor Interest Driven by Impact, Conviction and Choice, 2019.

3 Deloitte, Advancing environmental, social, and governance investing: A holistic approach for investment management firms, February 2020.

4 Source: Morningstar Sustainable Funds Weather the First Quarter Better Than Conventional Funds, April 3, 2020.

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield inherent in investing. All security transactions involve substantial risk of loss. Environmental, Social and Governance (ESG) Risk has factors that may cause the portfolio to forgo certain investment opportunities and/or exposures to certain industries, sectors or regions.

Past performance does not guarantee future results. This commentary has been prepared by Voya Investment Management for informational purposes. Nothing contained herein should be construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Any opinions expressed herein reflect our judgment and are subject to change. Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations, and (6) changes in the policies of governments and/or regulatory authorities.