Key Takeaways

Voya’s 2023 Survey of the Retirement Landscape included questions about plan sponsors’ priorities and challenges for their plans.

DC specialists may find our survey results helpful in aligning their service offerings with sponsors’ needs.

Our Benchmarking Your Priorities worksheet can be used as a discovery tool for sponsors and their DC specialists to pinpoint plan priorities for the next two years.

Our Benchmarking Your Priorities worksheet can help financial professionals who focus on the retirement plan market better understand the service needs and priorities of DC plan sponsor clients.

Are you a mind reader? Probably not. And that means that if you work with defined contribution plans and want to provide the best service possible, you need to ask plan sponsors the right questions—especially when it comes to identifying their priorities for the plan.

Sponsors’ top short-term priorities

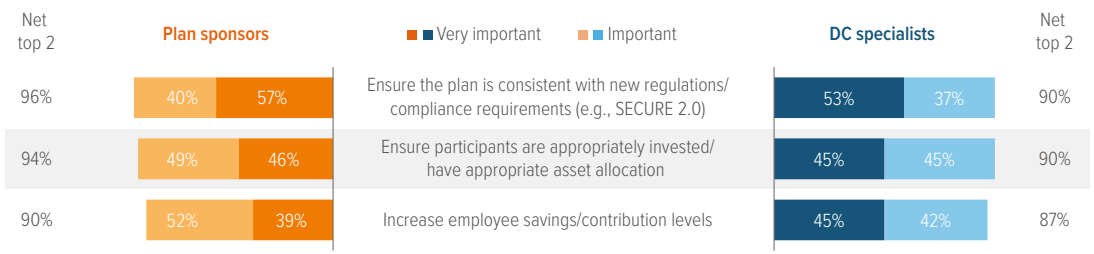

As in our 2021 and 2018 plan sponsor surveys, the 2023 edition asked sponsors to name their most pressing priorities for the plan in the next two years. The top concern for sponsors remained ensuring the plan’s regulatory compliance, which makes sense given the number of legislative changes brought about by SECURE and SECURE 2.0. Ensuring appropriate participant asset allocation and increasing participant contribution rates rounded out the top three concerns for sponsors.

The good news? DC specialists demonstrated strong awareness of these top three sponsor priorities (Exhibit 1).

As of 03/31/23. Source: Voya Financial, Voya IM.

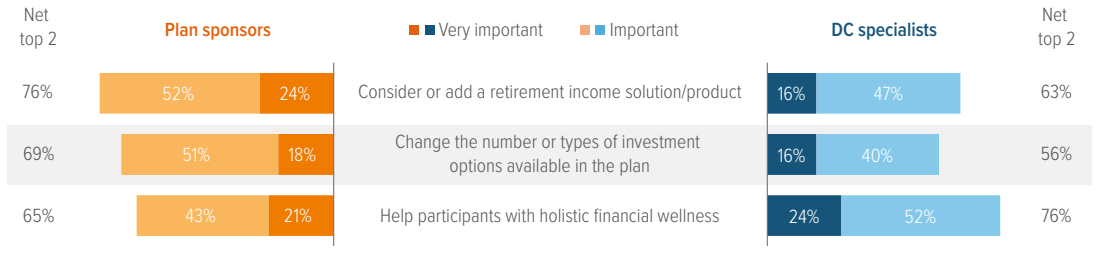

There were a few areas of disconnect between sponsor priorities and DC specialists’ perceptions in our survey. Sponsors placed a higher priority on adding a retirement income product/solution than DC specialists perceived. Similarly, changing the number or type of investments available in the plan was a higher priority to sponsors than DC specialists perceived. Meanwhile, DC specialists said holistic financial wellness was a higher priority for sponsors than it was (Exhibit 2)

As of 03/31/23. Source: Voya Financial, Voya IM.

A discovery tool for sponsors and DC specialists

To help your conversations with sponsors, we’ve created the Benchmarking Your Priorities worksheet. This worksheet can help sponsors define their priorities and assist DC specialists in better understanding them. The worksheet also offers insights into the priorities of the sponsors we surveyed in 2023, broken down by plan size. This can further help sponsors and their DC specialists understand what other sponsors of similar-sized plans consider priorities.