As we enter 2025, the global economic landscape offers a mix of opportunities and risks driven by supply-side dynamics, strong U.S. earnings, and evolving market relationships. Here are our three key themes for the year ahead:

Economic resilience: The U.S. economy continues to demonstrate resilience, with GDP growth fueled by strong consumer spending and business investment. The Atlanta Fed’s GDPNow model projects 3.3% growth for Q4 2024, indicating sustained economic momentum. However, headwinds such as tariffs and stricter immigration policies could hinder this trajectory and prolong inflationary pressures through 2025.

Robust U.S. earnings: Corporate earnings remain a key driver of market performance, with double-digit growth anticipated in 2025. While earnings growth provides a solid foundation for optimism, elevated valuations in some sectors introduce heightened risks of volatility and multiple compression.

As of 12/11/24. Source: Bloomberg.

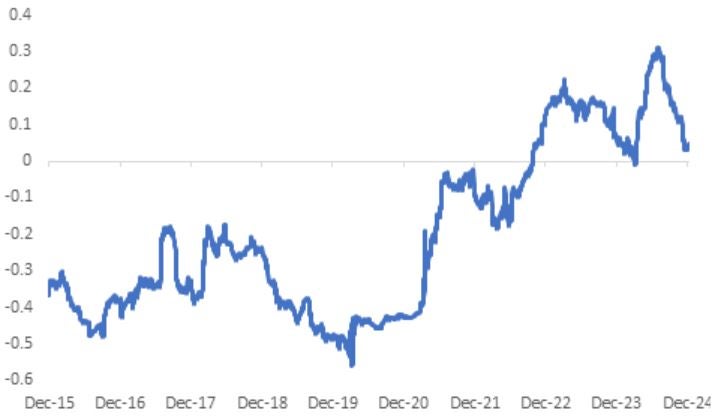

Shifting stock-bond correlation: The past couple years have seen the traditional inverse relationship between stocks and bonds weaken, reducing bonds’ effectiveness as a hedge. High correlations can also indicate market bubbles. Encouragingly, recent trends indicate a reversal, with declining correlations restoring bonds’ diversification benefits. This shift highlights the need for investors to reassess portfolio allocations to fixed income in order to leverage their renewed hedging potential.

What does this mean for investors? As central banks continue the rate-cutting cycle, both U.S. equities and high-quality core fixed income appear well-positioned to deliver strong returns, and the improving stock-bond dynamic supports diversified multi-asset portfolios in delivering solid risk-adjusted returns.

Maverick Lin contributed to this article.