The last few weeks have given us a slew of U.S. economic data. 1Q24 GDP increased just 1.6% (versus an expected 2.5%), while March CPI came in hot at 0.4% MoM (expected 0.3%) and 3.5% YoY (expected 3.4%).

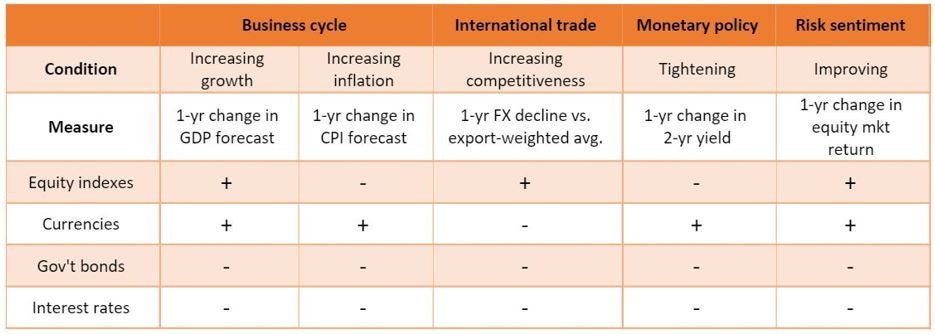

Given the recent U.S. inflation and GDP data, we thought it would be an opportune time to update our views on U.S. equities using the macro momentum framework. The main idea of macro momentum is to go long assets where fundamental macroeconomic trends are improving, and short assets where trends are deteriorating.

Macro momentum considers four key macroeconomic trends:

- Business cycle―one-year changes in GDP growth and CPI inflation

- International trade―one-year changes in spot foreign exchange rates

- Monetary policy―one-year changes in the two-year benchmark bond yield

- Risk sentiment―one-year changes in equity market returns

For example, bullish signals for equities include increasing GDP growth, declining inflation, improving international trade competitiveness (or depreciating currency), loosening monetary policy, and improving risk sentiment.

Source: Adapted from “A Half Century of Macro Momentum,” Jordan Brooks, AQR Capital Management, August 2017.

Using data reported by Bloomberg, let’s assess the macro momentum signals to do a quick case study on where U.S. equities stand as of April 30, 2024:

- Business cycle: ✖ GDP growth stood at +1.6% versus +2.2% 1y ago (QoQ), Δ= -0.6%

- Inflation: ✔ stood at +3.5% versus +4.9% one year ago, Δ= -1.4%

- International trade: ✖ The Bloomberg Dollar Spot Index is 1266 today versus 1227 one year ago, Δ=+3.2%

- Monetary policy: ✖ The two-year benchmark government bond yield is +5.03% today versus +4.00% one year ago, Δ=+1.03%

- Risk sentiment: ✔ The S&P 500 Total Return Index is 10951 today versus 8928 one year ago, Δ=+22.7%

For the first time in a while, the macro signals are tilted towards negative economic momentum: GDP growth is deteriorating, monetary policy is tightening, and the currency is appreciating.

Even though inflation is still falling, it has been surprising to the upside recently. Given the recent macro backdrop, we would argue that we might be at an inflection point in the business cycle—and any overweights to risk assets should be held cautiously.

Maverick Lin contributed to this article.