As we wrap up the first month in 2025, the global economic landscape continues to be weighed down by policy uncertainty. According to the latest Chief Economists Outlook from the World Economic Forum, 56% of chief economists expect weaker global economic conditions in 2025, compared to only 17% expecting improvement. But what about the U.S.?

The good news is, optimism around U.S. growth remains elevated, as the country’s economic momentum remains quite robust. The latest Atlanta GDPNow growth estimate for Q4 remains at 3.0% and macro momentum indicates that domestic equity returns can continue. Investors may even be underreacting to the U.S.’ strong economy.

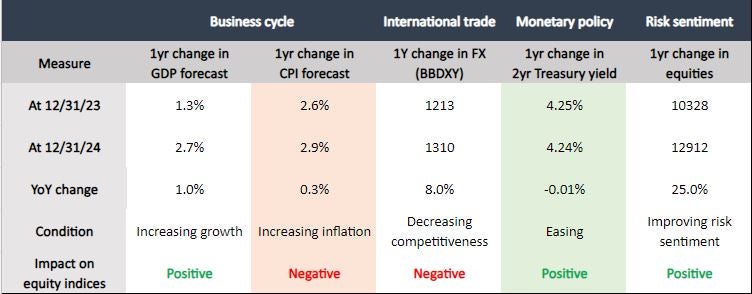

Using data reported by Bloomberg, let’s assess the macro momentum signals to do a quick case study on where U.S. equities stand as of December 31, 2024:

Business cycle: ✔ GDP growth stood at +2.7% versus +1.3% 1yr ago (QoQ), Δ=+1.4% ✖ Inflation stood at +2.9% versus +2.6% one year ago, Δ=+0.3%

International trade: ✖ The BBDXY Index is 1310 today versus 1213 one year ago, Δ=+8.0%

Monetary policy: ✔ The two-year benchmark government bond yield is +4.24% today versus +4.25% one year ago, Δ=-0.01%

Risk sentiment: ✔ The SPXT Index is 12,912 today versus 10,328 one year ago, Δ=+25.0%

The macro signals are slightly mixed, but still indicate strong economic momentum. GDP forecasts have increased, monetary policy is easing, and risk sentiment is positive. Although the CPI forecast is higher and the dollar has appreciated (most likely around the threat of tariffs), robust growth seems to suggest that a continued overweight to US equities seems justified.

Maverick Lin contributed to this article.