While recent cracks in consumer spending bear monitoring, consumers (and the fixed income sectors they help propel) are still well positioned.

Key takeaways

- While spending is slowing from elevated post-Covid levels, headlines suggesting a broad slowdown in U.S. consumer spending are exaggerated—historically strong labor markets, elevated real income and increased wealth from asset appreciation should continue to support consumers.

- Broadly speaking, we believe consumer spending in aggregate will continue to propel economic growth.

- However, selectivity in this environment is key as pockets of weakness are emerging—we favor investments tied to higher-income consumers and consumer staples, and are underweight investments tied to lower-income consumers and discretionary spending.

Resilient consumers have been the backbone of the current economic expansion

U.S. consumers play a crucial role in driving economic growth, historically contributing more than 60% to the country’s GDP.1 In the wake of the Covid shutdown, consumer spending has soared. At this stage of the market cycle, any shifts in consumer behavior can have significant implications for the overall economy. Understanding the current state of U.S. consumers is vital for investors looking to gauge future economic performance and the fixed income markets influenced by consumer spending.

As of 06/30/24. Source: J.P. Morgan.

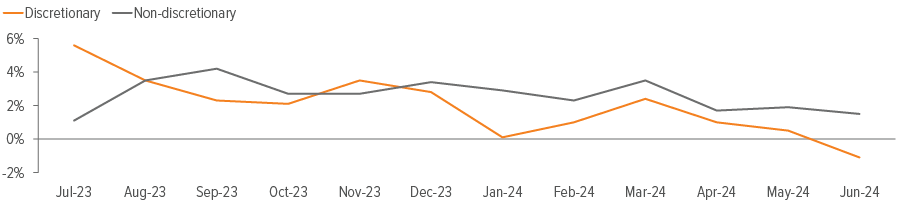

Yes, some consumer trends are showing cracks

Some signals point to a consumer slowdown, with less discretionary spending and more focus on discounts:

- Auto companies are increasingly offering incentives to stimulate purchases, signaling a potential softening in consumer demand for vehicles.

- Discount airlines are experiencing growth at the expense of legacy carriers, suggesting that consumers are prioritizing cost savings in travel expenses.

- Sales of big-ticket discretionary items are weakening, reflecting a cautious approach by consumers towards non-essential spending.

But consumers still have plenty of things going in their favor

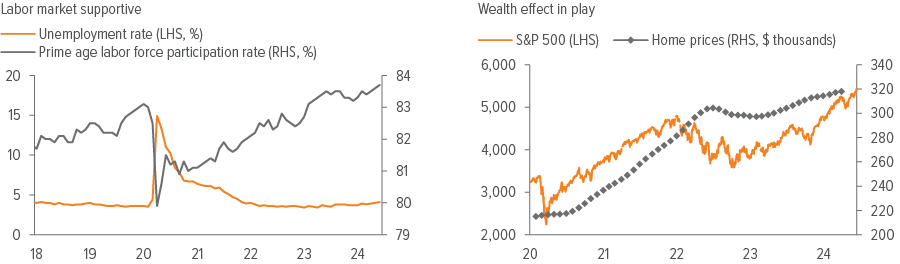

Consumers have several tailwinds at their back. Despite recent disappointing jobs data, unemployment remains low by historical standards.

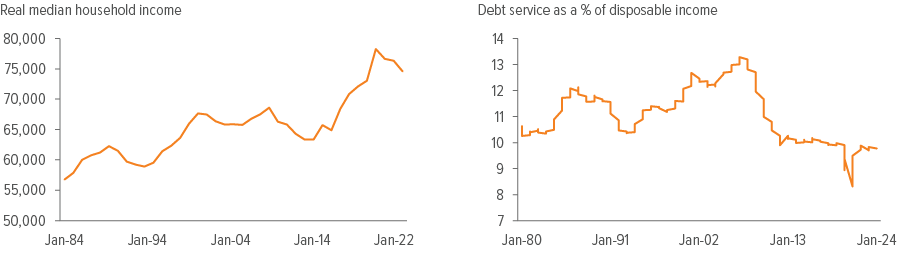

Meanwhile, household balance sheets remain on sound footing, as rising stock prices and home price appreciation have increased household net worth (Exhibit 2). Furthermore, the cumulative impact of recent wage growth has led to historically high levels of income, which makes current debt levels very manageable (Exhibit 3).

In addition to this supportive macroeconomic backdrop, recent data continue to suggest that consumers are in a position of strength. Real consumer spending ticked up in June (+2.6% year over year; +1.6% 6-month average annualized rate).2 Furthermore, according to the Bureau of Economic Analysis, second-quarter GDP growth was recently revised higher amid stronger consumer spending.

Left panel: As of 06/30/24. Source: U.S. Bureau of Labor Statistics. Right panel: As of 01/01/24. Source: Federal Reserve Bank of St. Louis.

Source: Federal Reserve Bank of St. Louis. Real median household income is as of 2022 census (latest available data) and debt service as a % of disposable income is as of January 1, 2024.

Growing dispersion between high- and low-income consumers

In aggregate, consumers appear well positioned. However, there is a growing divergence between higher-income and lower-income consumer cohorts. For example, lower-income consumers have less of a buffer from the wealth effect, as households in the top 20% of the income distribution accounted for around 68% of total household assets and 71% of net worth as of March 31, 2024.3 This dispersion between consumers is also manifesting in auto loans, where delinquency rates for subprime loans are starting to increase and outpace delinquencies for prime loans.

Fixed income implications

- While any significant cracks in the labor market or consumer incomes would exacerbate the burgeoning slowdown in consumer spending trends, as long as these markets remain strong by historical standards, we believe the outlook for the U.S. consumer is positive.

- As a silver lining for broader risk assets, the backdrop of resilient but slowing economic growth, combined with cooling inflation, gives the Fed more space to cut rates.

- We currently favor investments tied to higher-income consumers, as lower-income borrowers are more likely to feel the strain of stalling economic growth and less likely to benefit from the buffer of higher stock and home prices.

- For corporate bonds, we favor investments that are less tied to discretionary spending and generate more of their revenue through the sales of essential consumer goods.

A note about risk

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.