The recent move higher in rates presents an attractive entry point for ratcheting up fixed income allocations, even as spreads have tightened.

Recent CPI and PPI data may seem like a defining line in the sand between two different market outlooks. The downward inflation trend late last year caused many investors to price in Fed rate cuts as soon as early 2024. These optimistic expectations sent bond yields lower and prices for risks assets sharply higher. Today, lingering inflation and resilient growth took a March rate cut off the table, and the narrative around the Fed’s pivot to a more dovish policy stance has stalled.

Where does that leave investors?

For those worried they missed out on the opportunity to allocate to fixed income late last year (before the previous decline in rates), this recalibration in the market offers a second chance. Last month, we cautioned that when it comes to rate cuts, the trend matters more than the “when.” While recent CPI and PPI suggest inflation is taking its time to come down, nothing in the data suggests a reversal of inflation’s overall downward trend and the Fed’s eventual shift to more dovish policy, a point that Chairman Powell reiterated in his most recent press conference.

While some investors might be disappointed by the lack of price gains from near-term rate cuts, market expectations are now in line with the Fed’s dot plot. In the meantime, the reset in yields to higher levels presents attractive carry opportunities (Exhibit 1). Just keep calm and clip those coupons.

At 5.62%, investment grade bonds pay roughly the same yield that junk-rated B bonds did a decade ago.

As of 03/15/24. Source: Bloomberg Index Services Limited, Voya IM. Treasury as represented by the Bloomberg US Treasury Index. Yields by credit quality as represented by the Bloomberg US Corporate Aa, A and Baa subindices and the Bloomberg US High Yield Corporate 2% Issuer Cap Ba and B subindices. Dark blue dashed line represents the US Treasury Index yield, and the light blue dashed line represents the Bloomberg US Corporate Baa Index yield. Past performance does not guarantee future results.

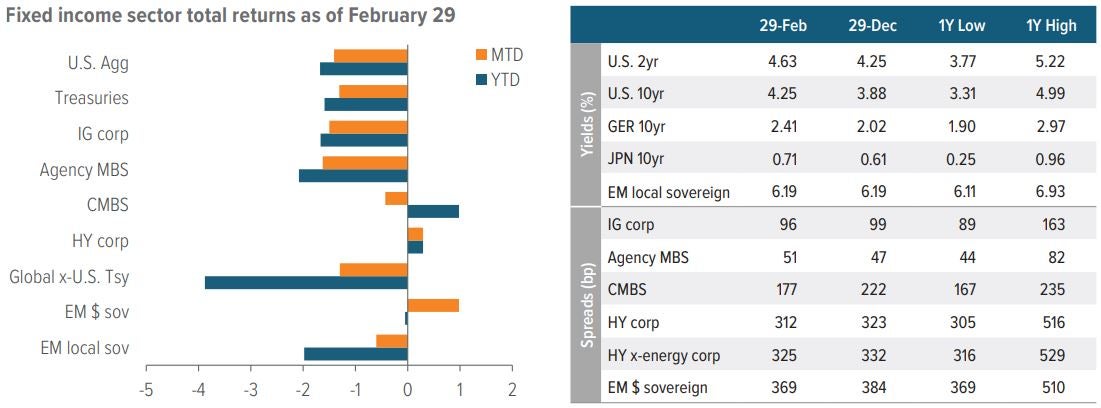

As of 2/29/24. Sources: Bloomberg, JP Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

Sector outlooks

Investment grade corporates

- Higher overall rates provide support for the investment grade credit asset class.

- Supply of new bonds outpaced last year’s issuance levels, a technical market dynamic that finally weighed on spreads late in February, despite steady inflows.

- While corporate earnings remain resilient, we continue to favor a defensive posture given current valuations.

- From a positioning standpoint, banking valuations remain attractive but timing is crucial given the elevated supply.

High yield corporates

- While higher interest costs have begun to weigh on credit quality, high yield defaults and credit stress are likely to plateau at lower levels than investors had feared.

- The technical backdrop remains supportive as supply has continued to underwhelm and demand for risk assets has been supported by strong equity market performance.

- From a positioning standpoint, we are overweight builders/building products, healthcare/pharma and energy. We are underweight technology and financials, as well as media/telecom companies with structurally challenged business models

Senior loans

- Senior loans remained resilient in February despite more volatile returns for other credit and fixed income asset classes.

- Ongoing refinancing activity continues to provide issuers with opportunities to extend maturities.

- Defaults have increased from historically low levels and we expect the trailing default rate to increase further in 2024, potentially reaching (and even exceeding) its historical average.

- From a positioning perspective, we continue to avoid consumer reliant issuers with weaker credit profiles, particularly those with a discretionary offering and exposure to a low to mid-tier consumer, which should face the most downward earnings pressure in the near term.

Agency mortgages

- While February prepayment speeds are expected to increase, the general backdrop for prepayments is expected to remain muted due to a slow housing market and dampened refinancing activity.

- The performance of agency mortgages will be closely correlated with overall volatility and rate directionality in the near term.

- Longer-term, fundamentals and the supply environment favor the asset class for 2024.

Securitized credit

- Fundamentals have improved across much of the securitized credit market and the near-term outlook is favorable across most sub-sectors.

- CLOs: The asset class continued its outperformance in February and we continue to like CLOs in the near term. Easing financial conditions and resilient U.S. growth measures, should temper investors’ deeper, longer standing credit concerns (although these concerns may resurface later in 2024).

- CMBS: Following the sector’s recent outperformance, we are less enthusiastic about its prospects in the short term. Longer term, the fallout in commercial real estate continues to be a significant source of risk.

- ABS: The sector is poised to outperform in the short term and we view spread widening from heavy issuance volumes as a tactical opportunity.

- Non-agency RMBS: The asset class continues to benefit from a favorable technical backdrop with low new issuance volumes and investors mostly unwilling to sell into secondary markets.

Emerging market debt

- Emerging market debt should continue to benefit from the improved global macro environment and easing monetary conditions in the U.S.

- While China’s latest policy response appears to have stabilized the country’s economic activity, housing and private sector confidence remain negative and additional stimulus is unlikely.

- Rate cutting cycles should continue across Latin America and Europe as the disinflation trend continues.

- EM corporate fundamentals remain resilient and the corporate default rate is expected to be lower due to fewer defaults in Asia and Europe.

A note about risk The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. |