When it comes to rate cuts, the trend matters more than the “when,” and current market dynamics point to a continued environment of solid growth and cooling inflation.

It’s been a little over a month since I assumed the role of Head of Investments and CIO of Fixed Income for Voya Investment Management. As I take the pen from our CEO, Matt Toms, I look forward to bringing you the insights of our 250+ person fixed income platform. Looking at the current backdrop, the focal point for both market participants and policymakers remains on the trajectory of inflation and the Fed’s response to it. Here is a breakdown of the key trends we are monitoring in this environment.

A disconnect between market expectations for rate cuts and the media narrative

As rates rallied amid inflation’s downward trend in 2023, the financial media started to publish more articles about a growing consensus for a rate cut early in 2024. Now, following recent remarks from Chairman Powell indicating that the Fed is not likely to reach a level of confidence to cuts rates in time for its March meeting, the narrative is starting to turn. What’s missing here is an understanding that the market’s expectations for future rate movements are significantly more nuanced. The consensus reflects a distribution of outcomes, which includes some probability of a large recession that requires significant rate cuts. After Powell’s latest remarks and strong economic data releases, the market’s expectations for cuts have declined, and the anticipated timing has been pushed out further into 2024.

All else being equal, the Fed leans dovish

While the main narrative on rates is fixated on “when” the cuts will start, from a positioning perspective it’s more important to focus on the fact that we are in a solid growth environment with inflation trending downward. As long as this trend remains, the backdrop will be favorable for spread assets, and the Fed will be inclined to ease monetary policy.

My experience working at the Federal Reserve Bank of New York taught me that, despite its recent hawkish stance (which came about as a result of inflation rates at 40-year highs), the Fed inherently leans towards dovish policies. This inclination was challenged in 2022, which marked the first time since the 1980s that inflation emerged as a contentious political issue, prompting the Fed to adopt a more stringent approach. However, in scenarios where growth and inflation are at odds, the Fed is likely to favor lower rates unless inflation escalates. The good news for investors is that current market dynamics continue to support the downward trend of inflation.

Think of inflation in bands

Investors are closely monitoring inflation indicators, including both actual inflation rates and inflation expectations, as these will guide the Fed’s policy decisions. The recent labor market data exhibiting strong demand has led to market volatility, whereas signs of weakening growth have had a calming effect. The ideal scenario for bond markets in the early months of 2024 involves moderate growth and cooling inflation, which could justify modest rate cuts without reigniting demand pressures.

Yet here again, I would avoid becoming overly fixated on the monthly CPI prints and recognize that the trend matters more than one specific data point. Given all the inputs into inflation (from both supply and demand), it’s hard to pin a trajectory to one point in time. While it doesn’t communicate this in its monthly meetings, the Fed thinks of inflation in bands. When you get to 9% headline, you’re not in range. When inflation reaches 3% and trending down, you’re in range. Even if we have a hiccup or two of higher inflation (like we saw with the most recent monthly data), as long as the downward trend continues and growth remains resilient, spread assets should continue to benefit.

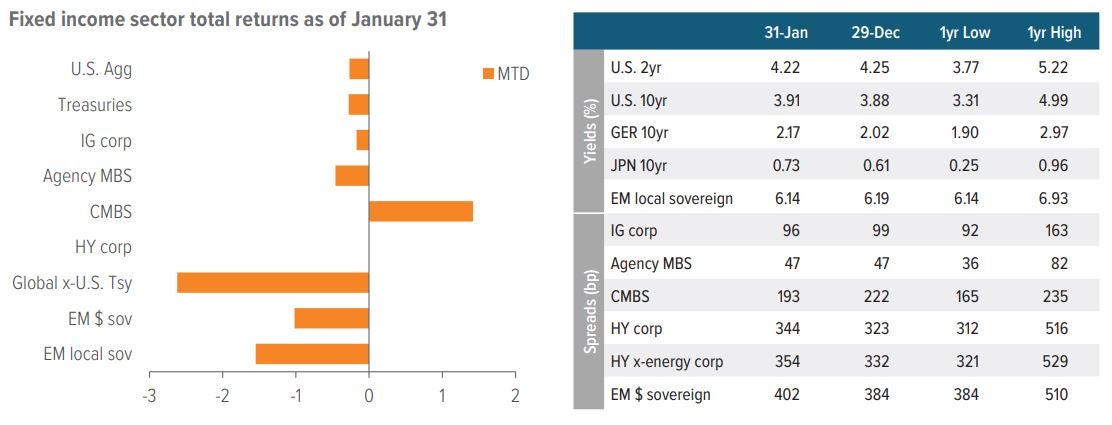

As of 01/31/24. Source: Bloomberg, J.P. Morgan, Voya IM. See disclosures for more information about indices. Past performance is no guarantee of future results.

Sector outlooks

Investment grade corporates

- The macroeconomic backdrop remains supportive for investment grade (IG) corporates, as strong earnings data indicates that corporate fundamentals should remain solid.

- Technicals remain the key driver of IG corporate spreads, with investors adding to IG allocations even as yields are well off their highs.

- While corporate earnings remain resilient, we continue to favor a defensive posture given current valuations.

- From a positioning standpoint, banking valuations remain attractive, and we see more opportunities in the front and intermediate segments of the credit curve than in longer-dated bonds.

High yield corporates

- The outlook for high yield is improving, as resilient economic growth and falling inflation suggest that credit problems will be idiosyncratic rather than widespread.

- Equity forecasts suggest earnings bottomed in the third quarter and, while credit quality improvement is largely behind us, credit deterioration remains limited.

- The deluge of cash into high yield has slowed from late-2023 levels, but supply continues to underwhelm. With all-in yields near 7%, we expect fund flows to be balanced going forward.

- From a positioning standpoint, we are overweight builders/building products, health care/pharma and energy. We are underweight technology and financials.

Senior loans

- Senior loans remained resilient in January despite more muted returns for other credit and fixed income asset classes.

- Refinancing and repricing activity continued to be the main driver of issuance in the primary market, and CLO issuance continued to provide supportive tailwinds for the asset class.

- 3Q23 earnings for senior loan issuers were mixed, as key metrics showed further signs of deterioration, particularly among lower-rated borrowers. Negative earnings themes flagged by issuers pertain to some early weakening trends among lower-income consumer cohorts (retail), continued pressure on linear advertising business models (broadcasting), destocking (packaging and chemicals), and capital needs (telecom and media).

- From a positioning perspective, we are underweight auto, consumer discretionary, food & beverage, pharma, home health and power. We continue to avoid consumer-reliant issuers with weaker credit profiles, particularly those with discretionary offerings and exposure to low- to mid-tier consumers, which should face the most downward earnings pressure in the near term.

Agency mortgages

- January prepayment speeds are expected to decrease by 2% as weak seasonals weigh on refinancing activity.

- The performance of agency mortgages will be closely correlated with overall volatility and rate directionality in the near term.

- 2024 supply projections vary significantly based on rate expectations and housing market trends. However, overall, fundamentals should remain a positive influence on mortgage returns for most of 2024.

Securitized credit

- Much of the securitized credit market displays improving fundamentals and is benefiting from encouraging economic growth—but expect some turbulence as overly optimistic Fed predictions are brought down to earth.

- CLOs: The asset class outperformed in January, and we continue to favor CLOs in the near term.

- CMBS: The sector should continue to benefit from the rally lower in rates in the near term; however, longer term, the fallout in commercial real estate continues to be a significant source of risk.

- ABS: After outperforming in January, we expect the space will struggle to generate attractive excess returns in the near term.

- Non-agency RMBS: Like CMBS, this space benefits directly from improving financial conditions and is well positioned to continue the strong performance it experienced in January. Unlike CMBS, the space should also benefit from strong underlying fundamental support.

Emerging market debt

- Emerging market debt is benefiting from the improving macroeconomic environment and absolute yields that are attractive relative to historical levels.

- While China’s latest policy response appears to have stabilized the country’s economic activity, housing and private sector confidence remain negative.

- Rate-cutting cycles should continue across Latin America and Europe as the disinflation trend continues.

- While several major economies will have elections in 2024, we broadly expect policy continuity, with incumbent parties likely to win in India, Mexico and South Africa

|

A note about risk The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition. |