A Transparent, Rules-Based Approach to Help Clients Build Wealth

Voya Global Perspectives believes fundamentals drive markets and, paired with a rules-based investment discipline, may remove emotion from investing and avoid the folly of gaming diversification. Using the Global Perspectives investment philosophy as a framework, a transparent rules-based approach is applied consistently to help clients build wealth.

“Gaming diversification” — reactively chasing returns based on short-term fads or abandoning assets that underperform — tends to expose investors to unintended risks and leads to disappointing results. Global Perspectives uses a disciplined allocation signal to emphasize risk mitigation by employing a defensive positioning when negative year-over-year earnings growth is observed. Following the signal allows the portfolio to adapt to fundamental market drivers while avoiding timing errors and high transaction costs of frequent trading.

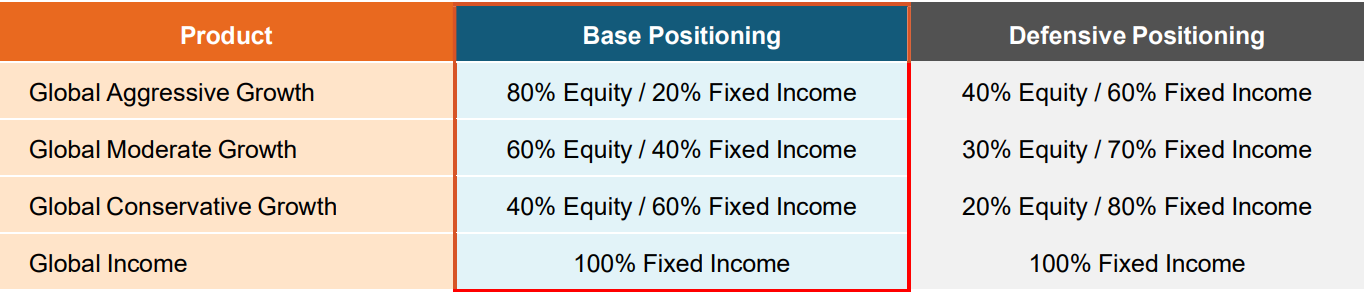

Current Positioning of GP Portfolios: Base

For the quarter ending September 30, 2025 — actual company reporting finishing in December 2025 — the YoY earnings growth for the S&P 500 companies was +14.9%. 1 With earnings growth greater than 10%, the GP strategy will maintain base positioning and rebalance back to targets in early January 2026.

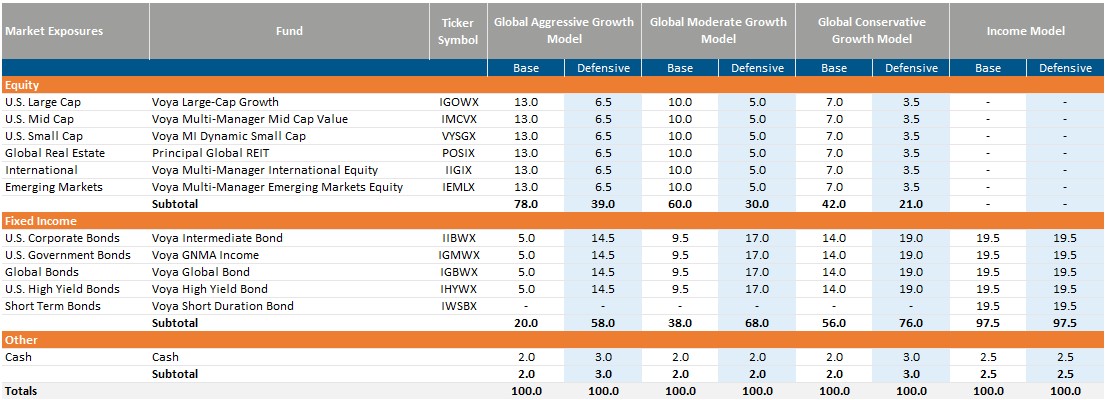

Global Perspectives Asset Allocation

May form a stronger foundation for investment success

May enhance returns, reduce risks and lower trading costs

For the times when a defensive posture is more prudent than "stay the course"

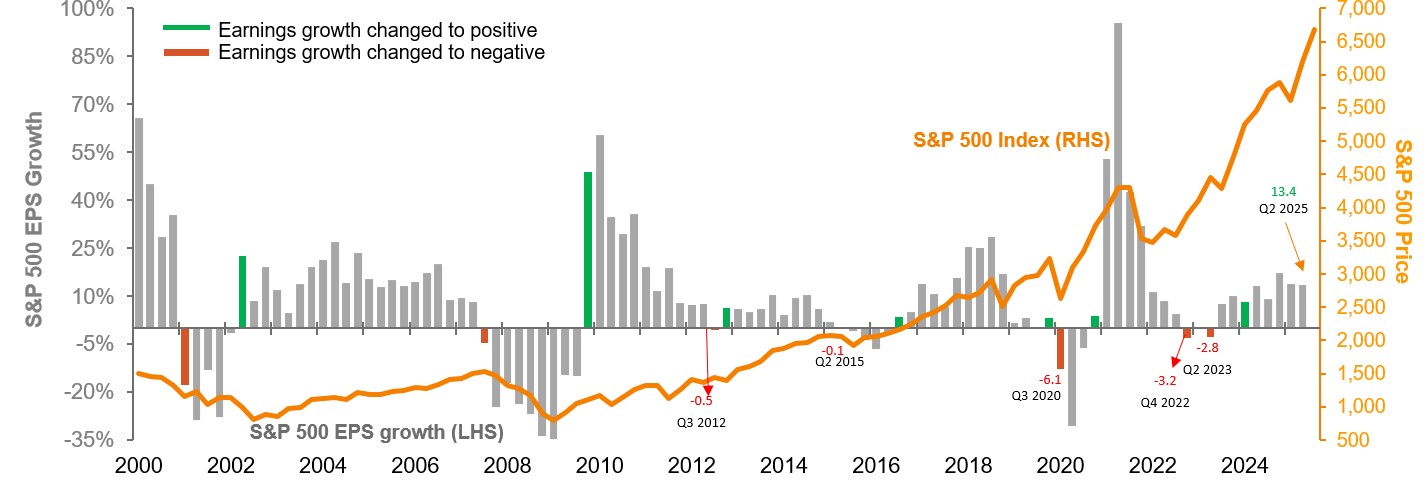

Fundamentals Drive Markets

Corporate earnings growth is a barometer for the health of the global economy.

Source: Refinitiv – Thomson Reuters and FactSet, Voya Investment Management, as of 09/30/2025. Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. The S&P 500 index is a gauge of the U.S. stock market that includes 500 leading companies in major industries of the U.S. economy.

Featured Insights

Product Literature

Global Perspectives Market Models (GPMM) – Mutual Fund Series

There are four distinct Global Perspectives Market Models (GPMM) in the Mutual Fund Series: Global Aggressive Growth, Global Moderate Growth, Global Conservative Growth, and Income. Each model is comprised of 10 distinct mutual funds and follows a transparent rules-based approach to help clients build wealth with adjustments to the equity/fixed income allocation to match your risk tolerance. When positive year-over-year earnings growth is observed, base positioning is employed and when negative year-over-year earnings growth is observed, defensive positioning is employed.

- Voya Global Perspectives Strategy Story

- Voya Global Perspectives® Market Models—Mutual Fund Series Strategy Brief

- Voya Global Perspectives Client Presentation

- Voya Global Perspectives Performance Flyer (VFA)

- Voya Global Perspectives Performance Flyer

- Voya Global Perspectives Market Models—Mutual Fund Series Quarterly Commentary

- GPMM Quarterly Allocation Letter

- Voya GPMM MF Series - July 2025 Trade

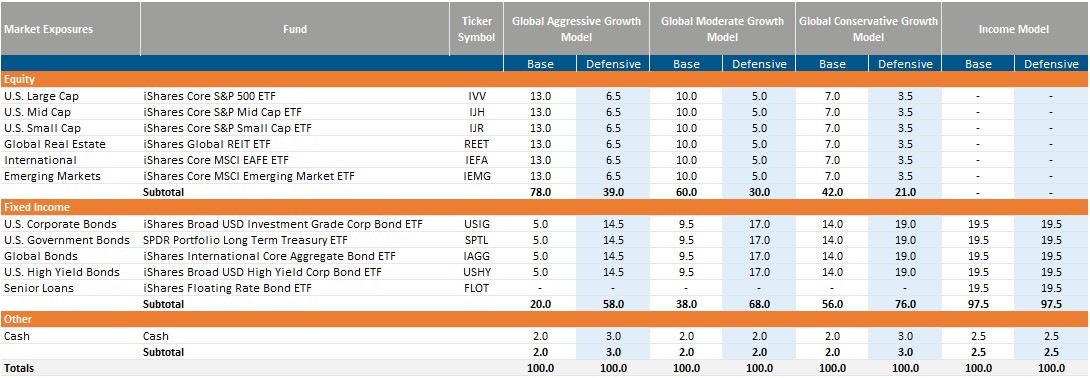

Global Perspectives Market Models (GPMM) – ETF Series

There are four distinct Global Perspectives Market Models (GPMM) in the ETF Series: Global Aggressive Growth ETF, Global Moderate Growth ETF, Global Conservative Growth ETF, and Income ETF. Each model is comprised of 10 distinct ETFs and follows a rules-based, disciplined approach to manage market volatility and investor behavior. When positive year-over-year earnings growth is observed, base positioning is employed and when negative year-over-year earnings growth is observed, defensive positioning is employed.

- Voya Global Perspectives Strategy Story

- Voya Global Perspectives® Market Models—ETF Series Strategy Brief

- Voya Global Perspectives Performance Flyer (VFA)

- Voya Global Perspectives Performance Flyer

- Voya Global Perspectives Market Models—ETF Series Quarterly Commentary

- GPMM Quarterly Allocation Letter

- Voya Global Perspectives Client Presentation

- Voya GPMM ETF Series - October 2023 Trade

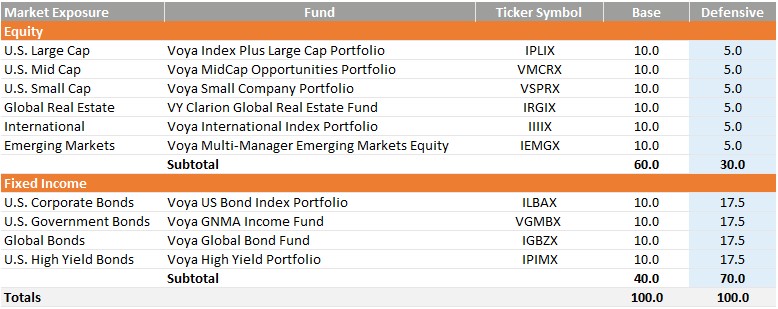

Global Perspectives Portfolio

The Voya Global Perspectives Fund invests in 10 broadly diversified funds and follows a transparent rules-based approach to help clients build wealth, including a disciplined allocation signal. When positive year-over-year earnings growth is observed, base positioning is employed and when negative year-over-year earnings growth is observed, defensive positioning is employed.

Get in Touch

At Voya Investment Management, a heritage of partnership and innovation serves clients at every step. Put the best team behind you with Voya’s leading investment advice: solutions built on research and adapted to your needs.

Have a question? Send our Global Perspectives team an email or fill out the form below.

Meet the Team

1 Source: Refinitiv, London Stock Exchange Group, Institutional Brokers’ Estimate System., as of 9/22/25

Principal Risks

All investing involves risks of fluctuating prices and the uncertainties of rates of return and yield. Asset Allocation: The success of the Fund’s strategy depends on the Adviser’s or Sub-Adviser’s skill in allocating Fund assets between the asset classes and in choosing investments within those categories. There is a risk that the Fund may allocate assets to an asset class that underperforms other asset classes. Investment Model: The Fund or certain underlying funds invest based on a proprietary model managed by the manager. The manager’s proprietary model may not adequately address existing or unforeseen market factors or the interplay between such factors. Other Investment Companies: The main risk of investing in other investment companies, including exchange-traded funds, is the risk that the value of the securities underlying an investment company might decrease. Because the Fund or an underlying fund may invest in other investment companies, you will pay a proportionate share of the expenses of those other investment companies (including management fees, administration fees, and custodial fees) in addition to the expenses of the Fund and a proportionate share of the expenses of each underlying fund. Interest Rate: With bonds and other fixed rate debt instruments, a rise in interest rates generally causes values to fall; conversely, values generally rise as interest rates fall. The higher the credit quality of the instrument, and the longer its maturity or duration, the more sensitive it is likely to be to interest rate risk. Foreign Investments/Developing and Emerging Markets: Investing in foreign (non-U.S.) securities may result in the Fund or the underlying funds experiencing more rapid and extreme changes in value than a fund that invests exclusively in securities of U.S. companies due to smaller markets different reporting, accounting and auditing standards; nationalization, expropriation, or confiscatory taxation; foreign currency fluctuations, currency blockage or replacement; potential for default on sovereign debt; or political changes or diplomatic developments. Other risks of the Fund include but are not limited to Credit, High-Yield Securities Investments, Call, Company, Currency, Liquidity, Market, Market Capitalization, Real Estate Companies and Real Estate Investment Trusts, U.S. Government Securities and Obligations. An investment in the Fund is not a bank deposit and is not insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

The S&P Target Risk Moderate Index is an unmanaged index that measures the performance of a hypothetical, multi-asset portfolio designed to provide significant exposure to fixed income, while also providing increased opportunity for capital growth through equities.

The S&P Target Risk Aggressive Index concentrates on exposure to equities to benefit from opportunities for long-term capital accumulation. To enhance portfolio efficiency, it may include small allocations to fixed income.

The S&P Target Risk Conservative Index emphasizes exposure to fixed income to maintain a consistent income stream and manage volatility.

The Bloomberg Global Aggregate Index measures global investment grade debt from twenty-four local currency markets including treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging markets issuers.

Indices do not reflect fees, brokerage commissions, taxes or other expenses of investing. Investors cannot invest directly in an index.

The Fund discussed may be available to you as part of your employer sponsored retirement plan. There may be additional plan level fees resulting in personal performance to vary from stated performance. Please call your benefits office for more information.

This information is proprietary and cannot be reproduced or distributed. Certain information may be received from sources Voya Investment Management (“Voya IM") considers reliable; Voya IM does not represent that such information is accurate or complete. Certain statements contained herein may constitute "projections," "forecasts" and other "forward-looking statements" which do not reflect actual results are based primarily upon applying retroactively a hypothetical set of assumptions to certain historical financial data. Actual results, performance or events may different materially from those in such statements. Any opinions, projections, forecasts and forward-looking statements presented herein are valid only as of the date of this document and are subject to change. Nothing contained herein should be construed as (i) an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Voya IM assumes no obligation to update any forward-looking information.

Past Performance is no guarantee of future results.

For more complete information, or to obtain a prospectus on any Voya fund, please contact your investment professional or Voya Investments Distributor, LLC at (800) 992-0180 for a prospectus. The prospectus should be read carefully before investing. Consider the investment objectives, risks, and charges and expenses carefully before investing. The prospectus contains this information and other information about the funds. Check with your investment professional to determine which funds are available for sale within their firm. Not all funds are available for sale at all firms.