Though valuations and optimism about rate cuts could limit equity upside potential, U.S. corporate earnings growth has led us to move our Global Perspectives portfolios from a defensive posture to base positioning.

Executive summary

Valuations and optimism about rate cuts could limit upside potential for equities

- While we are encouraged by the progress of inflation and the resilience of consumers and corporations, we believe that noticeably slower economic growth, fair to modestly extended valuations, and optimistic forecasts regarding Fed rate cuts could limit the upside potential for stocks.

GP portfolios shift to base allocations

- With U.S. corporate earnings moving from negative to positive, we shifted our Global Perspectives portfolios back to base positioning in early January.

U.S. outperformance can persist

- We think U.S. equities will continue to outperform other countries and regions, driven by the strength of the U.S. consumer and superior corporate earnings growth from unrivaled innovation.

Fourth quarter 2023 review

U.S. equity markets ended the quarter on a high note, bolstered by economic resilience, waning inflation and a pause in the U.S. Federal Reserve’s interest rate hiking cycle. The S&P 500 Index rose by 11.69%, and the Nasdaq Composite Index advanced by 13.56%. Information technology stocks led while utilities lagged. Growth stocks outperformed value stocks during the quarter, and small caps beat large caps.

The U.S. bond market staged a comeback during the quarter. The Bloomberg U.S. Aggregate Bond Index gained 6.82% on the unexpected strength of the economy. The 10-year U.S. Treasury yield moved from 4.69% at the beginning of the quarter to 3.88% by quarter-end as inflation eased and expectations for interest rate cuts in 2024 grew.

As of 12/31/23. Source: FactSet, FTSE NAREIT, Voya Investment Management. The overall average model allocation includes 10 asset classes, equally weighted: S&P 500, S&P 400 Midcap, S&P 600 Smallcap, MSCI U.S. REIT Index/FTSE EPRA REIT Index, MSCI EAFE Index, MSCI BRIC Index, Bloomberg Barclays U.S. Corporate Bonds, Bloomberg Barclays U.S. Treasury Bonds, Bloomberg Barclays Global Aggregate Bonds, Bloomberg Barclays U.S. High Yield Bonds. Returns are annualized for periods longer than one year. Past performance is no guarantee of future results. An investment cannot be made in an index.

Outlook: Stay balanced in an uneven macro environment

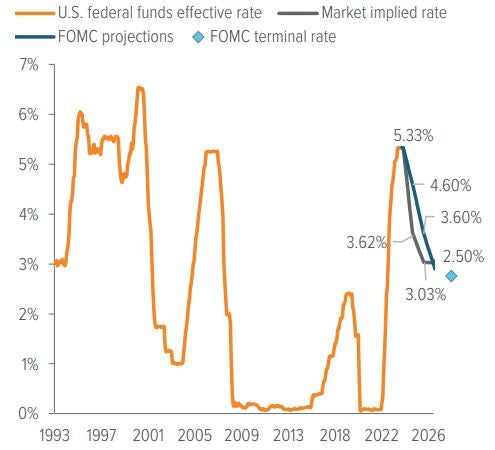

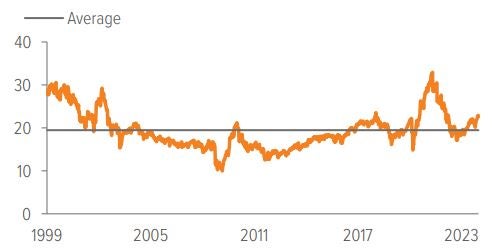

After the unexpectedly strong performance of the U.S. economy and capital markets last year, investors are entering 2024 with a more upbeat outlook. While we are encouraged by the progress of inflation and the resilience of consumers and corporations, we believe that noticeably slower economic growth, fair to modestly extended valuations, and optimistic forecasts regarding Fed rate cuts (Exhibit 1) could limit the upside potential for stocks. Rates are providing little room for yields to decline, unless there is a significant slowdown in economic growth. Despite high expectations, we believe that global stocks and bonds can still generate respectable returns throughout the year. The current environment presents opportunities for allocators to benefit from divergences in global policy, business cycles, and the pricing of risk. In this macro environment, we emphasize balance in our multi-asset portfolios, while also recognizing that U.S. exceptionalism is likely to persist.

As of 01/08/24. Source: Bloomberg, J.P. Morgan, Voya IM.

The disinflation process continues

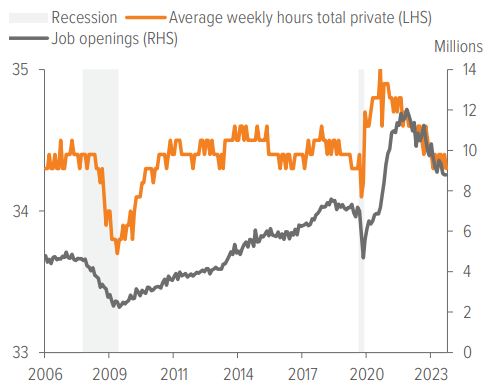

Since peaking at 5.6% in February 2022, core personal consumption expenditures (PCE) inflation has trended sharply lower, dropping to 3.2% year over year in November (Exhibit 2). Supply chain issues have eased considerably. Slowing demand-side forces have accounted for most of the recent relief, and we see more downside from factors such as shelter, where market rents suggest a clear trajectory towards 2.0–3.0% in 2024. Core services ex-housing remains a concern for the Fed. Transportation services, such as auto insurance and repair costs, are a source of heat but could decline if vehicle and auto parts prices start to fall. Additionally, weaker wage growth and consumer spending are expected as the lagged impact of tighter monetary policy further filters into the labor market, where there are early signs of softening—such as declining job openings and hours worked (Exhibit 3).

As of 11/30/23. Source: U.S. Bureau of Economic Analysis, Federal Reserve Bank of St. Louis.

As of 12/31/23. Source: Bloomberg.

Labor markets cooling

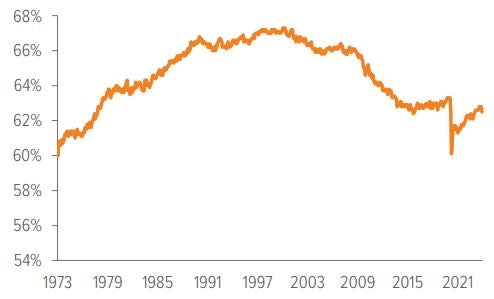

Despite our slow growth outlook and belief that unemployment will rise modestly from its current 3.7%, we don’t expect significant deterioration in the labor market. Limited private sector overreach and rising real incomes from falling inflation should keep the growth slowdown mild. Furthermore, the U.S. faces structurally lower labor force participation given its aging population (Exhibit 4), which supports labor demand. Also, after the pandemic highlighted talent shortages, companies may be marginally less inclined to fire. In this soft-landing scenario, U.S. fundamentals should hold up relatively well.

As of 12/31/23. Source: Federal Reserve Bank of St. Louis.

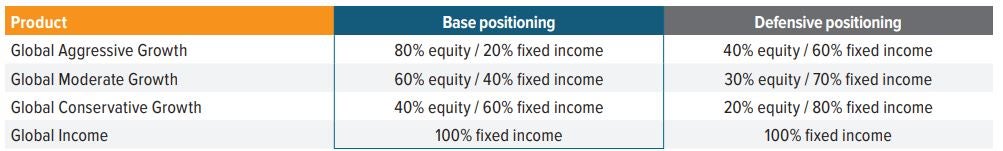

GP portfolios shift to base allocations as corporate earnings turn positive

S&P 500 third-quarter earnings grew by 7.2% year over year, with 10 of the 11 sectors showing increases. Energy was the sector that did not grow earnings, as it was up against tough comparisons from 2022, when crude oil reached prices exceeded $120 per barrel. The consumer discretionary sector led, with earnings rising by more than 13.5% compared with this time last year. In aggregate, earnings came in better than expected, with 82% of companies beating estimates. With U.S. corporate earnings moving from negative to positive, we shifted our Global Perspectives portfolios back to base positioning in early January (Exhibit 5).

Source: Voya Investment Management. For illustrative purposes only.

U.S. outperformance can persist

Looking ahead, estimates suggest year-over-year U.S. corporate earnings growth will be positive in 2024, accelerating in the back half of the year (Exhibit 6). We think U.S. equities will continue to outperform other countries and regions, driven by the strength of the U.S. consumer and superior corporate earnings growth from unrivaled innovation. The U.S. profit recession front-ran the U.S. economic recession that never happened. Proactive corporate right-sizing left earnings in a position to accelerate quickly off the trough and should support earnings growth ahead. Current estimates are for S&P 500 earnings growth of about 10% in 2024. We acknowledge that the risk to earnings appears skewed to the downside due to rising financing costs and dampened demand; however, in our view, a high-single-digit return is achievable. Returns would be roughly the same should valuations remain unchanged, which seems realistic given they are only moderately expensive versus history (Exhibit 7) and given our belief in the continuance of a U.S. equity premium (arising from numerous advantages and a lack of compelling alternatives.)

As of 12/31/23. Source: FactSet.

As of 01/05/24. Source: Bloomberg.

A note about risk Certain of the statements contained herein are statements of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All investments are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment is not guaranteed and will fluctuate. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) interest rate levels, (4) increasing levels of loan defaults, (5) changes in laws and regulations and (6) changes in the policies of governments and/or regulatory authorities. |