Getting your clients

back into bonds

Cash has a place in portfolios, but bonds are a better choice for locking in yields, boosting return potential and providing diversification benefits.

W H Y V O Y A

Bonds are back

With bonds once again offering attractive yields, fixed income is reclaiming its traditional role as an anchor for portfolios. Whether your needs are simple or complex, Voya can help, bringing deep experience and a breadth of solutions covering public and private markets.

Voya Fixed Income

S C A L E  Top 50 |

E X P E R T I S E  250+ |

S O L U T I O N S  $167B AUM |

Voya offers investment solutions for every client objective

From single-sector strategies to multi-sector funds, Voya offers a wide selection of fixed income investments to help meet your needs.

Diversifiers |

Voya Intermediate Bond Fund

Help strengthen your core by seeking consistency in an uncertain environment

Voya Strategic Income Opportunities Fund

An uncertain environment calls for an unconstrained approach

Or view our complete fixed income line up.

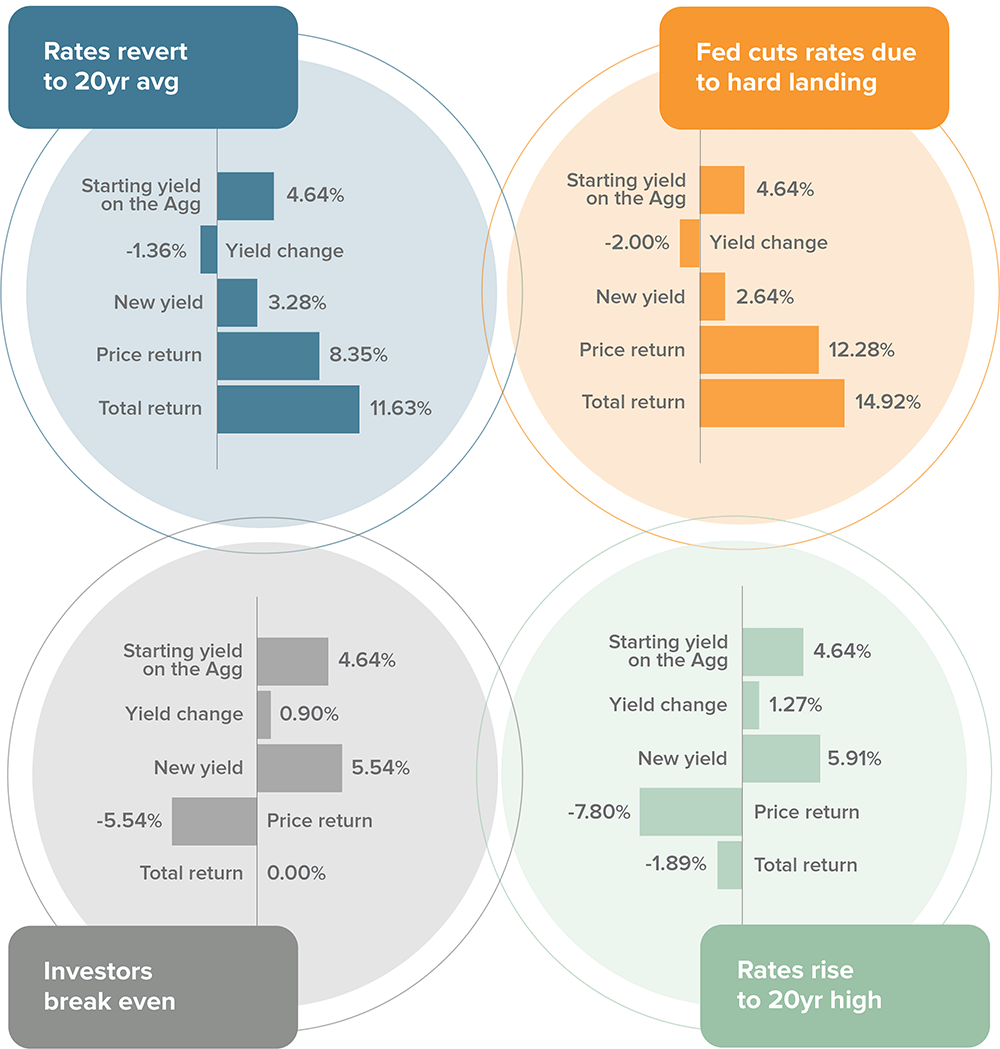

How might bonds respond in different scenarios?

As of 8/31/24. Source: Bloomberg, Voya IM. For illustration purposes only. Calculations based on the U.S. Agg current duration of 6.3 years and assume immediate parallel shift in yield curve and the new yield is then earned for the 12-month period. Investors cannot invest directly in an index. Index performance does not reflect the deduction of any fees, expenses or taxes. Index comparisons have limitations, as volatility and other characteristics may differ from a particular investment. Bonds pose a higher risk than Treasury bills, which are guaranteed as to the timely payment of principal and interest.

W H A T ' S N E X T

Watch our latest fixed income webinar

De-coding Unconstrained Fixed Income

Over ten years ago, Morningstar launched a category called “Nontraditional Bonds.” Investors have searched for the best ways to use these funds. Finally, the code has been cracked.

Join the experts at Voya Investment Management for a free educational webcast that unpacks how to approach nontraditional bond funds.

Chris Wilson, CFA Head – Global Client Portfolio Management, Voya Investment Management

Hans Sapra, Client Portfolio Manager, Voya Investment Management

Cinthia Murphy, Investment Strategist, VettaFi

This program is pending acceptance for one hour of continuing education (CE) credit by the Certified Financial Planner Board of Standards for the CFP® designation, The Investment and Wealth Institute for CIMA®, CPWA®, and RMA® designations and The American College of Financial Services.

Connect with Voya

I N S I G H T S & R E S O U R C E S

1 Voya Investment Management is the 48th largest institutional investment manager (out of 411 firms surveyed), based on worldwide institutional assets under management, on Pensions & Investments’ Top Money Managers list published June 2024. This ranking represents assets under management as of December 31, 2023. Participation in the P&I ranking is voluntary and open to firms that manage assets for U.S. institutional tax-exempt clients. Managers self-report their data via a survey. P&I sends the survey to previously identified managers and to any new managers asking to participate in the survey/ranking. No fee was paid for consideration.

2 As of 12/31/23. Voya Investment Management assets are calculated on a market value basis and include proprietary insurance general account assets of $33 billion.

A Note About Risks:

While the GNMA Income Fund invests in securities guaranteed by the U.S. Government as to timely payments of interest and principal, the Fund shares are Not Insured or Guaranteed.

The principal risks are generally those attributable to bond investing. All investments in bonds are subject to market risks as well as issuer, credit, prepayment, extension, and other risks. The value of an investment in a fund is not guaranteed and will fluctuate. Market risk is the risk that securities may decline in value due to factors affecting the securities markets or particular industries. Bonds have fixed principal and return if held to maturity, but may fluctuate in the interim. Generally, when interest rates rise, bond prices fall. Bonds with longer maturities tend to be more sensitive to changes in interest rates. Issuer risk is the risk that the value of a security may decline for reasons specific to the issuer, such as changes in its financial condition.

This has been prepared by Voya IM for informational purposes. Nothing contained herein should be construed as (i) an offer to sell or solicitation of an offer to buy any security or (ii) a recommendation as to the advisability of investing in, purchasing or selling any security. Opinions expressed herein reflect our judgment and are subject to change. Certain information may be received from sources we consider reliable, but we do not represent that such information is accurate or complete. Certain statements contained herein may constitute projections, forecasts or other forward-looking statements based on our current views and assumptions and may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those in such statements due to, without limitation, (1) general economic conditions, (2) performance of financial markets, (3) changes in laws and regulations and (4) changes in the policies of governments and/or regulatory authorities. The opinions, views and information expressed in this document regarding holdings are subject to change without notice. Information provided regarding holdings is not a recommendation to buy or sell any security. Fund holdings are fluid and are subject to daily change based on market conditions and other factors.

Past Performance is no guarantee of future results.